Eyes

Wide

Open

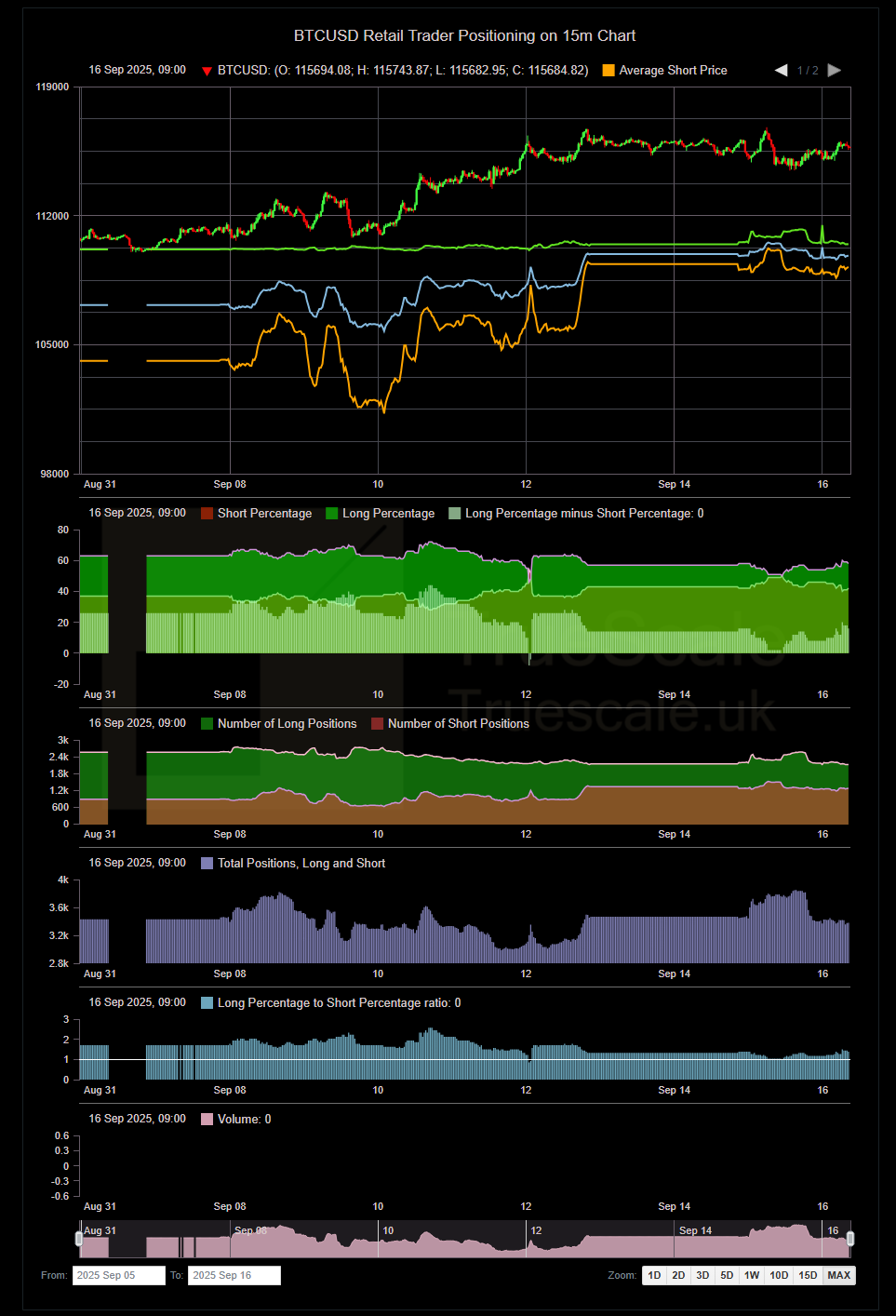

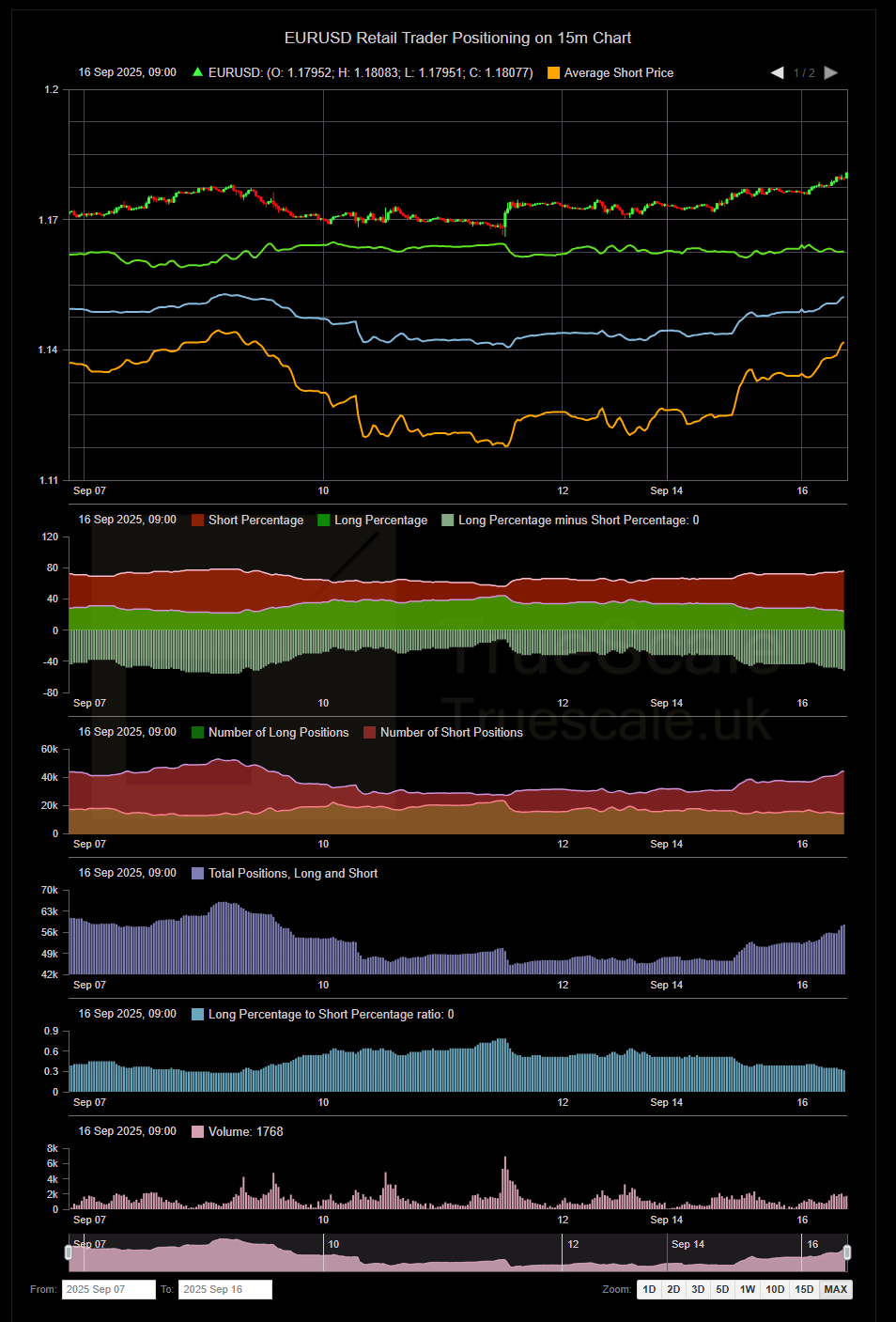

We provide comprehensive insights into retail traders’ positions across various financial markets. We gather data from reputable brokers, carefully aggregate and analyze it, and present it in easy-to-understand charts for our clients. Our platform offers visibility into retail positioning for a wide range of Stocks, Forex pairs, and cryptocurrencies, with an expanded selection of over 100 pairs available in our premium version, offering extensive historical data for deeper analysis.

Our charts display crucial information such as Short and Long percentages derived from all positions, along with their difference. Monitoring this difference is vital as it often signals a potential trend reversal when it crosses the zero line. Furthermore, we provide insights into the total number of Short and Long positions, as well as total open positions, offering valuable indicators of market sentiment. Increasing total positions often precedes significant market movements, providing traders with actionable insights.

Additionally, we offer insights into the average entry price for both buyers and sellers. This information sheds light on which side, buyers or sellers, market makers are exerting pressure on, potentially influencing market direction. Our platform empowers traders with essential data to make informed decisions in volatile markets.

Understanding and examining retail positions is crucial for several reasons:

Market Sentiment Analysis: Retail traders often exhibit certain behavioral patterns that can provide valuable insights into overall market sentiment. By analyzing retail positions, traders can gauge whether the majority of participants are bullish or bearish on a particular asset. This information can help in predicting potential market movements.

Contrarian Indicators: Retail traders tend to be more susceptible to emotional trading and herd mentality. Therefore, when retail sentiment becomes excessively bullish or bearish, it can serve as a contrarian indicator. In other words, when retail traders overwhelmingly take a particular position, it may signal an imminent reversal in the market.

Liquidity and Volume Analysis: Retail traders collectively represent a significant portion of trading volume in many markets. Monitoring retail positions can provide insights into liquidity levels and potential areas of price congestion or breakout. Understanding where retail traders are positioned can help in identifying areas of support and resistance.

Market Dynamics and Trends: Retail positions can reflect broader market dynamics and trends. For example, a surge in retail buying activity may indicate growing interest in a particular asset, potentially signaling the beginning of a new trend. Conversely, a decline in retail participation may suggest waning interest or exhaustion in an existing trend.

Risk Management: By tracking retail positions, traders can also manage risk more effectively. Understanding where retail traders are positioned can help in identifying potential areas of overcrowding or excessive leverage, which may increase the risk of sudden market reversals or volatility spikes.

We mean it, Use our data to your advantage.