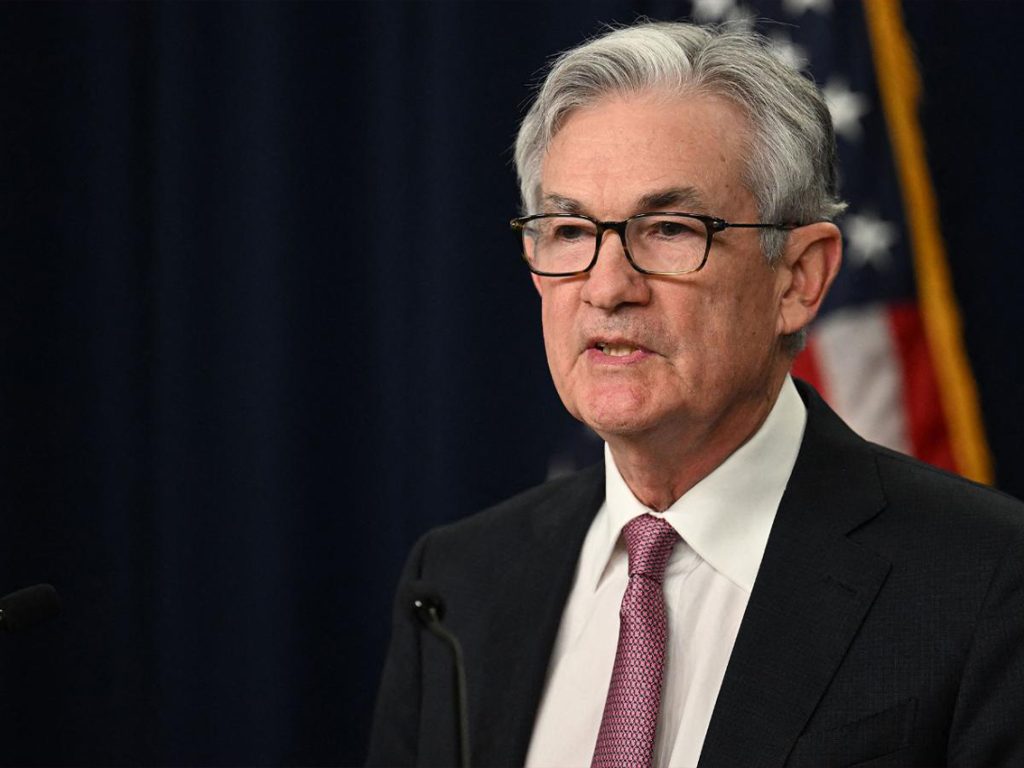

What does he say? and what we can interpret from his speech?

- Fed is not proactively responding to inflation, unlike Volcker who raised the rates above the CPI to Kill the inflation.

- It seems like Fed has no model to know if they are going to increase 75 or 100 BPS and they are guessing the right percentage points!

- Atlanta Fed says real GDP estimates is 0 and Powell says it is peaked up?!

- Powell says there is no sign of a slowdown in the economy while US households’ savings have plummeted to 2008’s level!

- The Fed will wake up soon and start to increase substantially, even by 100BPS or higher.

Bonus opinions

- With the CPI at 8.6%, a 1.75% interest rate is a joke. Fed is behind the curve, chasing inflation.

- Fed’s priority is managing inflation expectations and ignoring excess liquidity.

- The trend for retail sales is downward which means the strong consumer demand is a myth. inflation is eating consumers’ savings and forcing them to use debt (credit cards) to finance their needs.

- Prioritization in spending has already started which will slash earnings in the services and leisure sectors.

- Consumers will focus on essentials (little to no disposable income), like paying for rent, gas, school, food and etc.

- The job market is not strong as Fed thinks. With a tight economic condition, a big wave of layoffs will come.