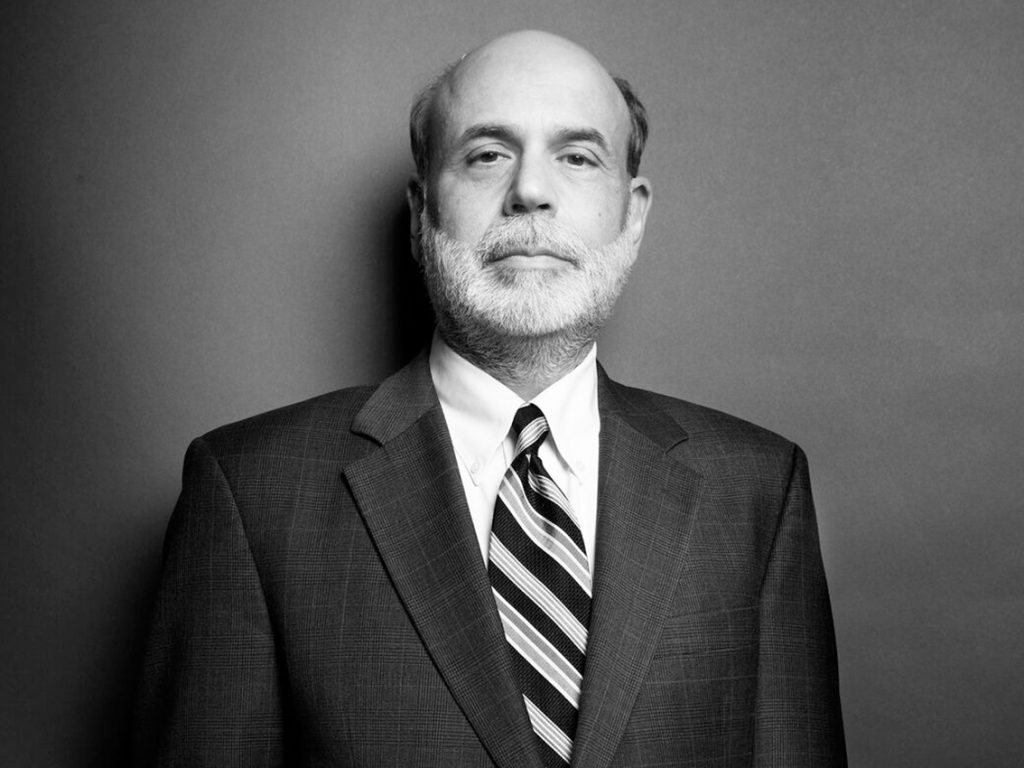

The economic crisis that occurred in 2008 was a severe and global financial crisis that impacted the United States and several other nations worldwide. The crisis led to a significant rise in unemployment, a contraction of credit markets, and a decline in asset prices. In response to the crisis, Chairman Ben Bernanke of the Federal Reserve played a critical role. He delivered a detailed analysis of the causes and consequences of the 2008 financial crisis and the tools available to the Federal Reserve to tackle such crises in his College Lecture Series titled “The Federal Reserve and the Financial Crisis.” The lecture series comprises four parts, with the second part concentrating on the origins of central banking, the Great Depression and the history after World War II, focusing on the role of the Fed in preventing a financial crisis. This article provides an overview of Bernanke’s lecture, emphasizing his observations regarding historical banking crises, responses, and consequences based on his viewpoint.

Independent Fed:

In the early part of the 20th century, the U.S. government recognized that the Federal Reserve needed to be allowed to operate independently, in order to achieve better results. This was the first clear acknowledgment by the government that the Federal Reserve should be allowed to operate in this way. The Fed’s primary concern in the 1950s and 1960s was macroeconomic stability, and they tried to follow a “Lean against the Wind Monetary Policy” to keep inflation and growth stable. However, in the late 1960s and 1970s, monetary policy became too easy, which led to a surge in inflation. Too easy monetary policy had led up to the Financial Crisis, exacerbated factors such as oil prices and government spending, wage-price controls, and broke the thermostat of the wage-price controls which led to an increase in inflation.

The legacy of Volcker:

In the 1970s, inflation began to rise after policymakers became too confident about their ability to keep the economy on an even keel. Paul Volcker, who was appointed chairman of the Federal Reserve in response to the increase in inflation, instituted a strong break in the way monetary policy was managed in order to address the inflation problem. This policy worked and inflation fell sharply, but it had negative consequences, including high interest rates that brought down economic activity and effective inflation.

In 1982, the unemployment rate was almost 11 percent, even higher than the most recent recession. Paul Volcker, Chairman of the Federal Reserve during this time, successfully brought down inflation by tightening monetary policy. This period, known as the “Great Moderation,” saw impressive economic growth and stability, and Alan Greenspan, Chairman of the Federal Reserve from 1987-2006, was able to maintain this stability. The US economy was extraordinarily stable between the mid-1980s and the mid-2000s due to monetary policy and other factors. The Great Moderation ended in 2007 with the onset of the financial crisis.

The Great Financial Crisis:

The housing bubble and the subsequent financial crisis were caused by a combination of factors, including an increase in house prices, deteriorating lending standards, and excessive optimism about the stock market. The housing bubble burst in 2007, leading to a sharp decline in home prices across the United States, which had severe consequences for borrowers (negative equity and delinquencies) and lenders (foreclosure).

The three main vulnerabilities of the financial system leading up to the crisis were over-borrowing, complex financial contracts, and a lack of risk management. The Federal Reserve played a major role in the financial crisis by creating liquidity in the market and providing oversight to banks and other financial institutions. However, they made mistakes in supervision and consumer protection, which led to a lot of risky behavior.

Bernanke suggests the increase in house prices in the early 2000s was not due to small changes in interest rates, the timing of the bubble, or the impact of the Asian financial crisis. He argues that the increase in house prices could be due to factors such as irrational optimism in the tech bubble or foreign capital inflows that occurred after the 1997-1998 Asian financial crisis.

Fed’s Response to the Great Financial Crisis:

The Fed responded to GFC by raising interest rates, which helped to stop the spiral of wage inflation and prices. The low inflation of the past decade made it easier for the Fed to keep rates low after the recession, which has helped to prevent a new housing bubble (!). Bernanke argues that although low interest rates may have contributed to the housing bubble, it’s important to balance this with other factors such as regulation and supervision. He also reminds the audience that the current low interest rates are a result of the recession, not the bubbly economy of the 2000s.

Bernanke discusses the importance of transparency in monetary policy, and how it has helped improve the effectiveness of policy over time. He also touches on the market volatility and how the Fed is working to maintain low inflation expectations. Bernanke also discusses the role of transparency in the Federal Reserve’s operations. He argues that it is important for the Central Bank to be transparent in order to ensure accountability.

Bonus:

The lecture itself contains more information about banking and historical responses to financial crises, so we suggest you watch it if you can.