The relationship between population and inflation has always baffled economists. This is mainly because of the complex nature of inflation that should be understood in relation to other economic data. Many pieces of research indicate that two demographics, below the age of 29 and above 59, substantially contribute to the inflation negatively. This is mostly due to the level of service and goods these two demographic consume without contributing to the economy. However, when they enter the job market, they provide goods and services for the economy and lower inflation.

To explain where the US inflation is headed, we will compare the US with Japan because many believe that the US is going to experience deflation as Japan did from 1995 to 2022.

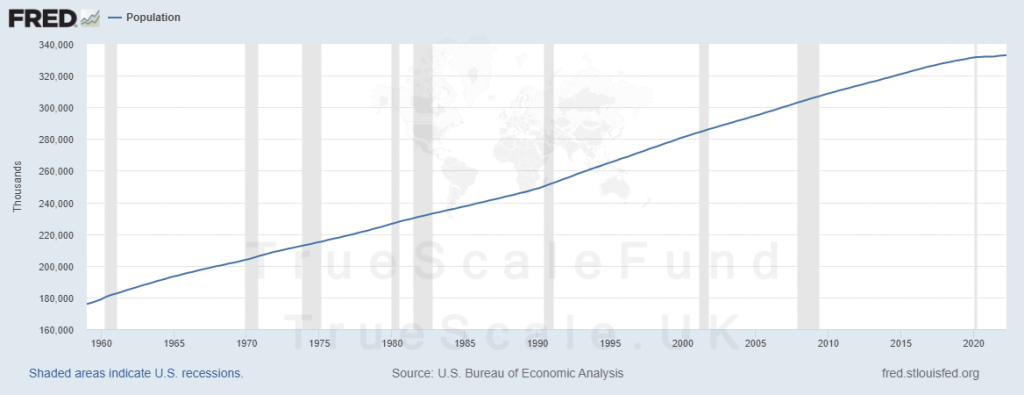

First, let’s look at the population of the US.

From 1945 to 2022, the total US population has been rising, though after 2020 the pace of change has slowed slightly.

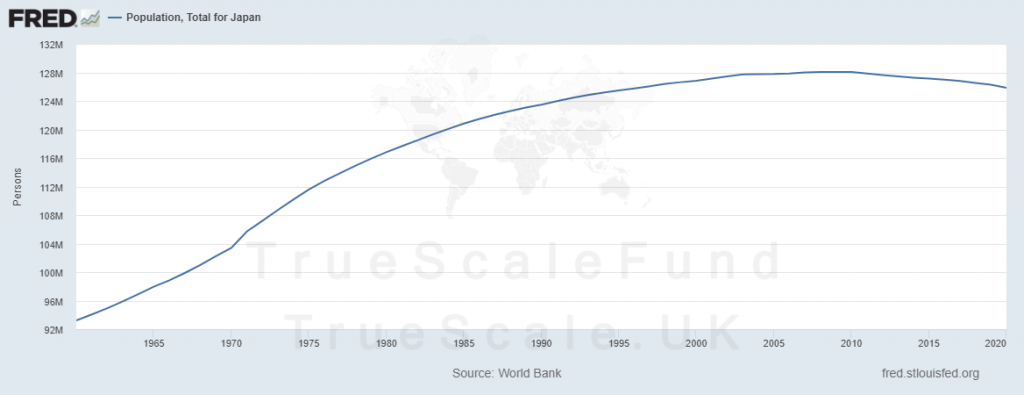

From 1950 to 2000, the total Japanese population rose, though after 2000 It shifted its course towards a steady decline.

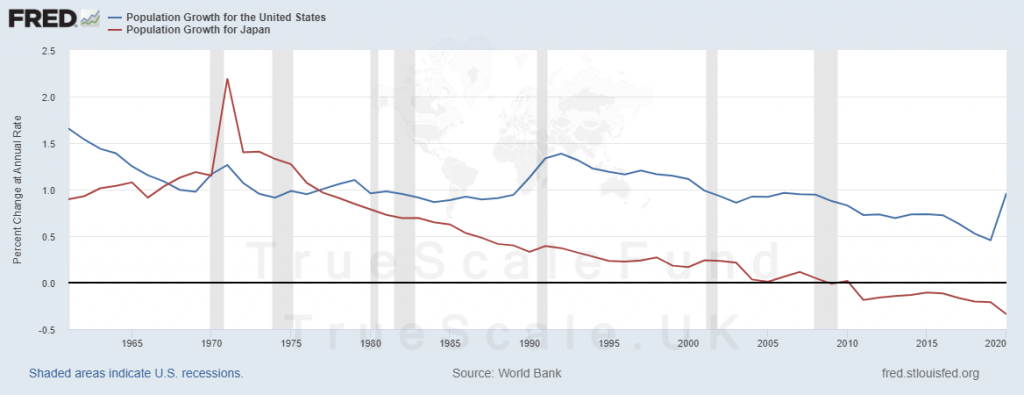

A sharp rise in the population rate of growth in the US after 2022 is more like Japan’s in 1970. overall, the trend is downward, and the main reason for that is the scarcity of resources.

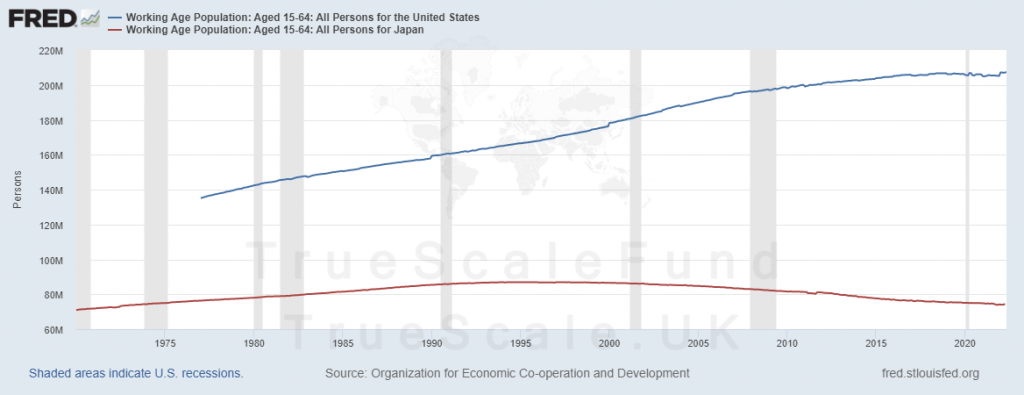

If you shift the chart for the working population in the US by 25 years, you will get the exact chart of japan’s working population. Since the trend for population rate of growth for both is the same, we will see a decline in population in the US, considering the fact that the working population is a derivative of the total population.

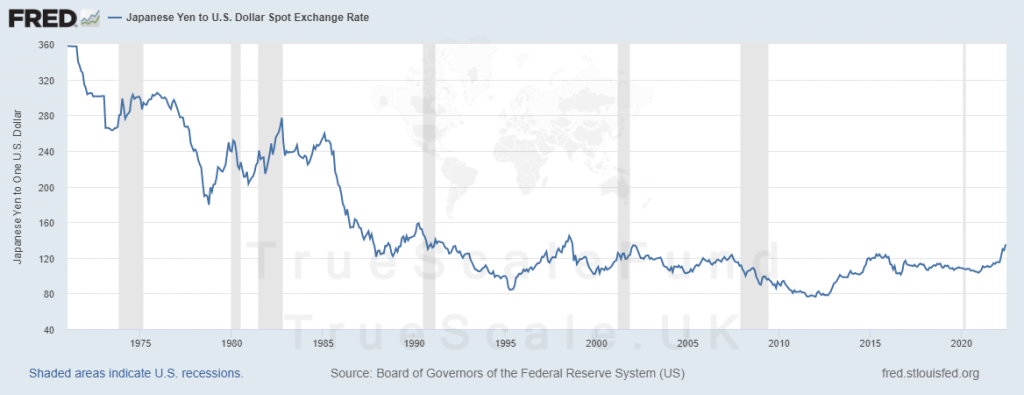

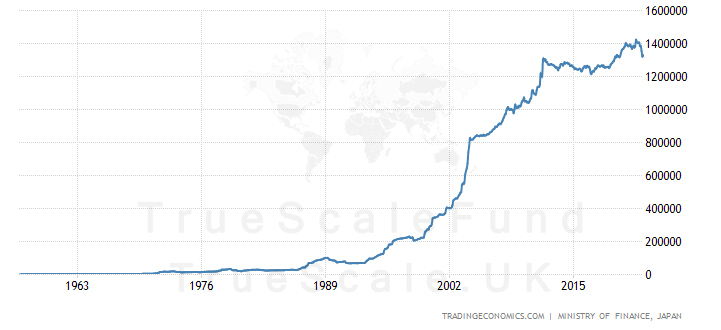

This is the chart of JPY to USD. During this period, Yen appreciated against the USD and pushed japan’s economy into a deflationary period. look closer and you will find out how the decline in population stabilized the yen mainly due to an increase in the government’s budget and a decrease in the working population in japan.

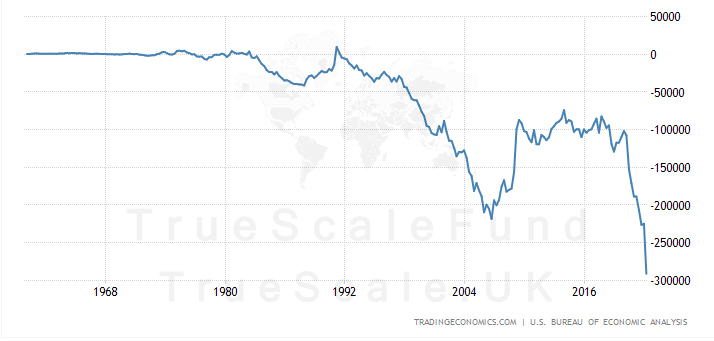

The chart of the United States Current Account shows how fast the US constantly exports dollars in exchange for goods and services.

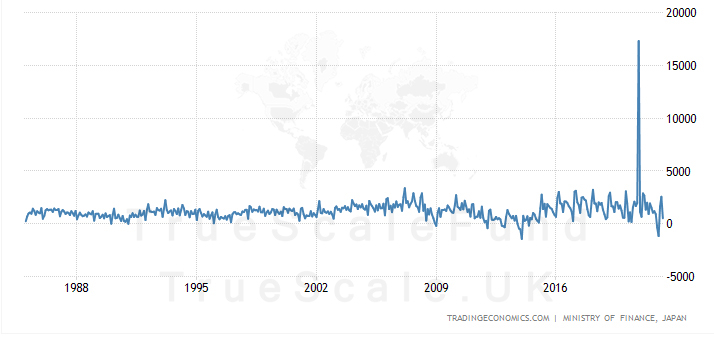

The chart of the Japan Current Account shows how Japan keeps its books in check with other nations (mainly US) by keeping the export and import numbers close to each other.

The US does not have the luxury of owning foreign assets, which makes sense. When you own the reserve currency, you are not concerned about adding foreign assets to your balance sheet.

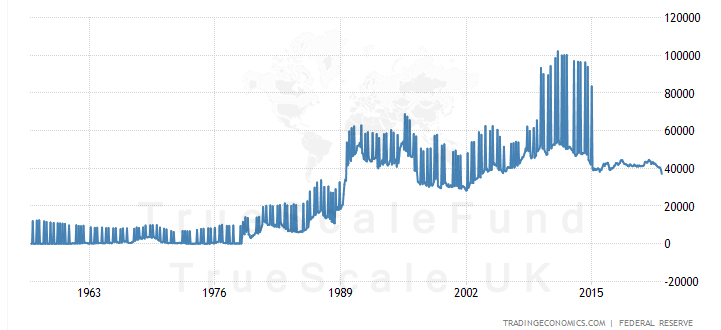

In comparison, BOJ owns foreign assets More than other CBs. This is mainly US treasuries since japan is the biggest buyer (financier) of US debt.

It is simple, there are no similarities between these two. Inflation in the US is going to be a major problem in the next few years. The US job market is not strong as Japan in 1995. Unemployment is going to rise in the US as a result of economic uncertainty and inflation, reducing the work performance of those between 29 and 59. Moreover, foreign CBs will reduce their US debt holdings to maintain the local currencies’ stability, which means more pressure on the Fed to run another round of QE.

This is our contrarian view for those who believe the US is the new Japan.