US Options Market Overview

The US options market remains the deepest and most liquid derivatives market globally, but underlying economic shifts can significantly influence pricing, volatility, and sentiment. Monitoring interest rates, corporate earnings, and macroeconomic indicators is essential for understanding market direction. This dashboard consolidates real-time data, helping traders interpret option flow, implied volatility, and key support/resistance levels.

While the US enjoys reserve currency status, changes in fiscal and monetary policy still have measurable impacts on the options market. Inflation trends, Fed rate decisions, and shifts in Treasury yields can ripple through implied volatility and skew. By tracking these macro drivers, traders can better position strategies—whether hedging, speculating, or generating income.

All the data above are exclusive to “TrueScale Fund, GB”, and should not be used or published without mentioning the source. All rights reserved for TrueScale, GB.

Report issues or request data: [email protected]

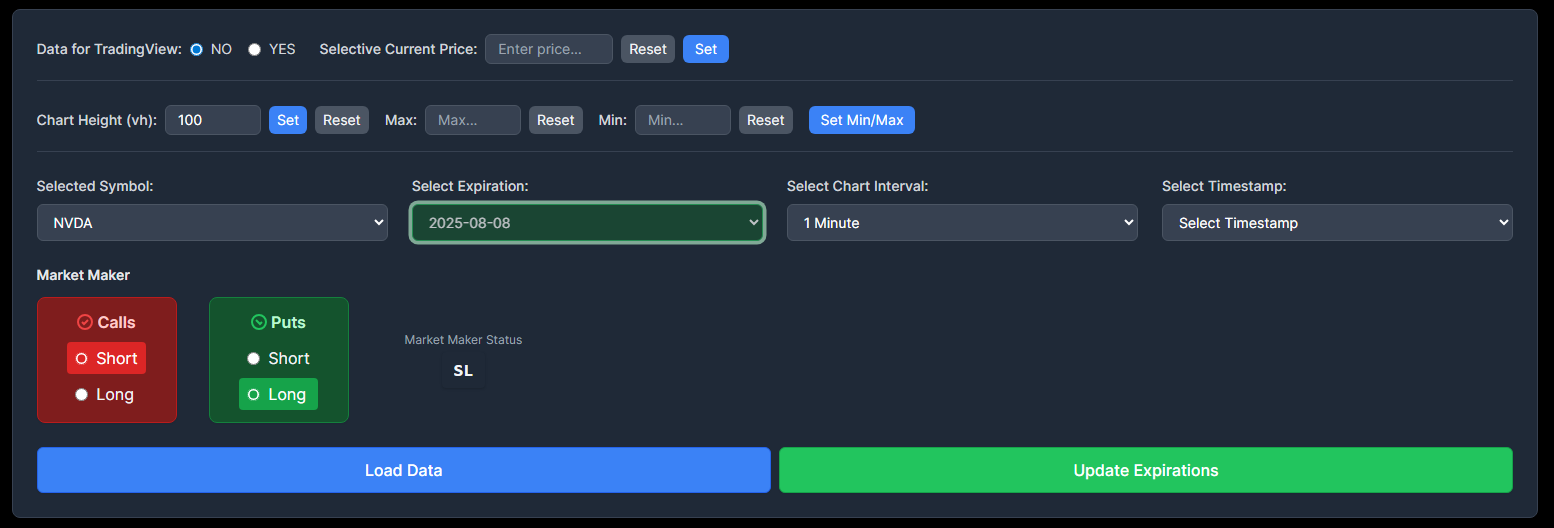

Option Trading Dashboard.

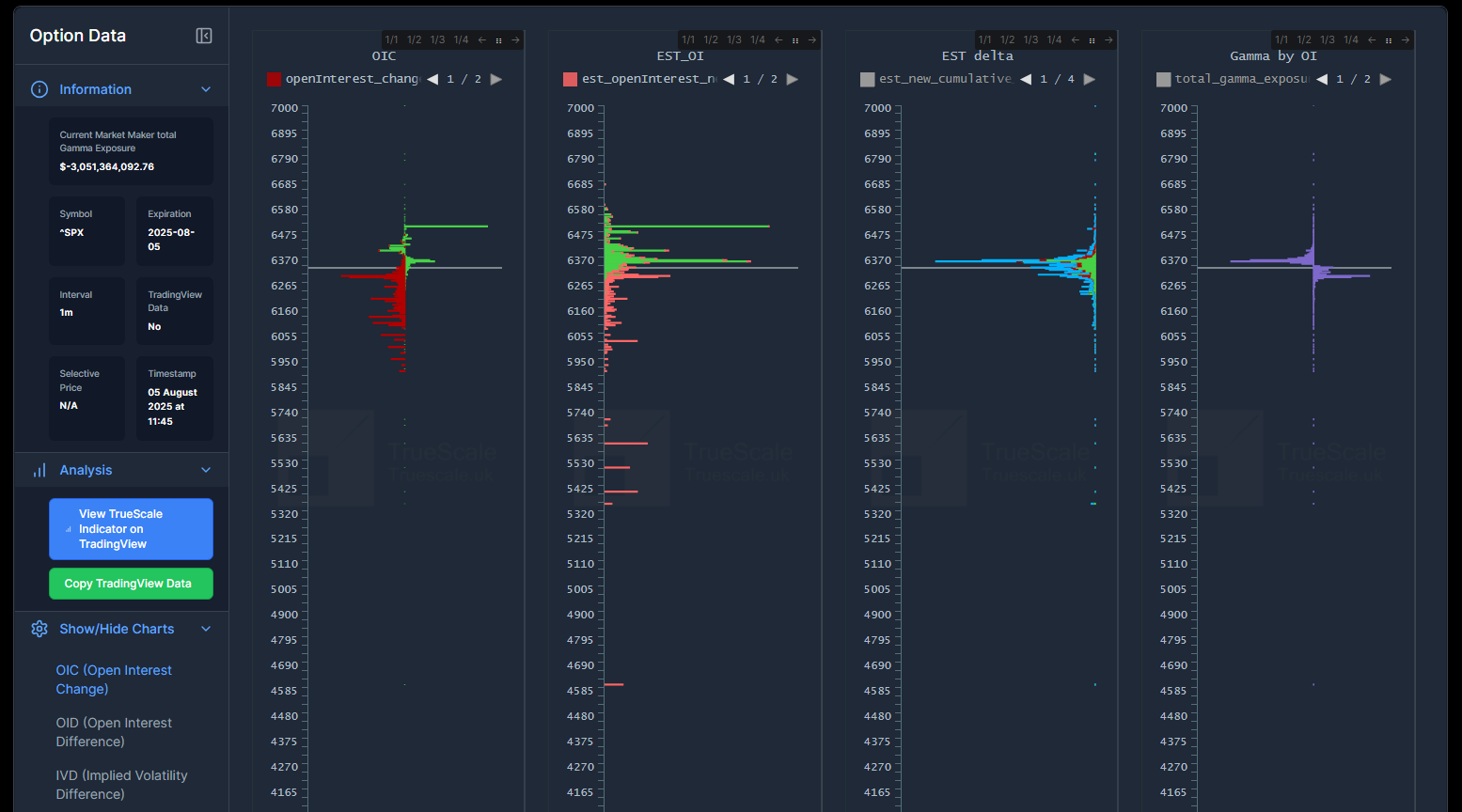

Our dashboard provides a set of analytical models to assess market sentiment and risk:

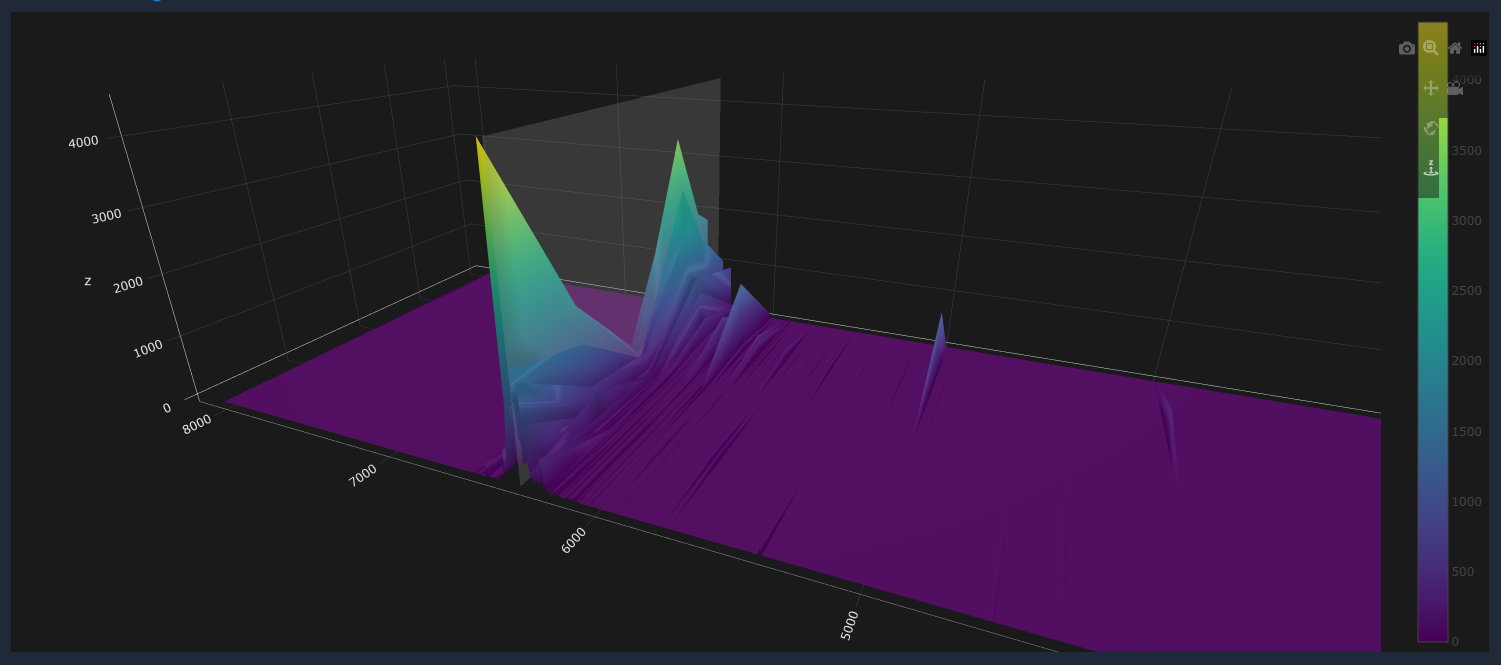

- Volatility Surface Tracking – Compare implied vs. realized volatility across maturities.

- Open Interest Heatmaps – Identify concentration of positions and potential pinning levels.

- Gamma Exposure Models (GEX) – Monitor dealer hedging pressures and potential volatility triggers.

- Flow Analysis – Track institutional trades, unusual volume, and momentum shifts.

These models work together to provide a clear, actionable view of the market—helping traders navigate opportunities in real time.

This tool isnow available in our new Market Data app.

What are Option Greeks?

Call Gamma:

Positive Gamma: Call gamma measures the rate of change of a call option’s delta concerning changes in the underlying asset’s price. When call gamma is positive, it means that small movements in the underlying asset’s price lead to larger changes in the call option’s delta. This implies that the option becomes more sensitive to changes in the underlying asset’s price, particularly as it moves closer to the option’s strike price.

Negative Gamma: Conversely, when call gamma is negative, it means that as the underlying asset’s price increases, the call option’s delta decreases, and vice versa. Negative gamma indicates that the option becomes less sensitive to changes in the underlying asset’s price as it moves further away from the option’s strike price.

Put Gamma:

Positive Gamma: Put gamma measures the rate of change of a put option’s delta concerning changes in the underlying asset’s price. When put gamma is positive, it means that small movements in the underlying asset’s price lead to larger changes in the put option’s delta. This implies that the put option becomes more sensitive to changes in the underlying asset’s price, particularly as it moves closer to the option’s strike price.

Negative Gamma: Conversely, when put gamma is negative, it means that as the underlying asset’s price decreases, the put option’s delta decreases, and vice versa. Negative put gamma indicates that the option becomes less sensitive to changes in the underlying asset’s price as it moves further away from the option’s strike price.

Call Vanna:

Positive Vanna: Call Vanna measures the rate of change of a call option’s delta concerning changes in implied volatility. When call Vanna is positive, it means that changes in implied volatility lead to changes in the call option’s delta in the same direction as the underlying asset. This implies that the option’s sensitivity to changes in volatility increases.

Negative Vanna: Conversely, when call Vanna is negative, it means that changes in implied volatility lead to changes in the call option’s delta in the opposite direction of the underlying asset. Negative call vanna indicates that the option’s sensitivity to changes in volatility decreases.

Put Vanna:

Positive Vanna: Put Vanna measures the rate of change of a put option’s delta concerning changes in implied volatility. When put Vanna is positive, it means that changes in implied volatility lead to changes in the put option’s delta in the same direction as the underlying asset. This implies that the option’s sensitivity to changes in volatility increases.

Negative Vanna: Conversely, when put Vanna is negative, it means that changes in implied volatility lead to changes in the put option’s delta in the opposite direction of the underlying asset. Negative put Vanna indicates that the option’s sensitivity to changes in volatility decreases.

Call Charm:

Positive Charm: Call charm measures the rate of change of a call option’s delta concerning changes in time to expiration. When the call charm is positive, it means that as time passes, the call option’s delta becomes more positive. This implies that the option becomes more sensitive to changes in the underlying asset’s price as expiration approaches.

Negative Charm: Conversely, when the call charm is negative, it means that as time passes, the call option’s delta becomes more negative. A negative call charm indicates that the option becomes less sensitive to changes in the underlying asset’s price as expiration approaches.

Put Charm:

Positive Charm: Put charm measures the rate of change of a put option’s delta concerning changes in time to expiration. When the put charm is positive, it means that as time passes, the put option’s delta becomes more positive. This implies that the option becomes more sensitive to changes in the underlying asset’s price as expiration approaches.

Negative Charm: Conversely, when the put charm is negative, it means that as time passes, the put option’s delta becomes more negative. A negative put charm indicates that the option becomes less sensitive to changes in the underlying asset’s price as expiration approaches.

What are the Different scenarios i can use Option Greeks?

Scenario 1: Upward Price Movement

Upward Price Movement with Positive Gamma and Positive Vanna:

As the underlying asset’s price increases, positive gamma causes call options to become more sensitive to the price movement, leading to an increase in option prices.

Positive Vanna further amplifies this effect, as changes in volatility also contribute to an increase in option prices.

Positive charm adds to the bullish sentiment, as call options become more sensitive to changes in the underlying asset’s price as expiration approaches.

Overall, the combination of positive gamma, positive Vanna, and positive charm enhances the bullish momentum, potentially leading to a continuation of the upward price movement.

Scenario 2: Downward Price Movement

Downward Price Movement with Negative Gamma and Negative Vanna:

As the underlying asset’s price decreases, negative gamma causes call options to become less sensitive to the price movement, leading to a decrease in option prices.

Negative Vanna further exacerbates this effect, as changes in volatility now contribute to a decrease in option prices.

Negative charm reinforces the bearish sentiment, as call options become less sensitive to changes in the underlying asset’s price as expiration approaches.

Overall, the combination of negative gamma, negative Vanna, and negative charm intensifies the bearish momentum, potentially leading to a continuation of the downward price movement.

Scenario 3: Upward Price Movement

Upward Price Movement with Positive Gamma and Positive Vanna, Negative Charm:

As the underlying asset’s price increases, positive gamma causes call options to become more sensitive to the price movement, leading to an increase in option prices.

Positive Vanna further amplifies this effect, as changes in volatility also contribute to an increase in option prices.

Negative charm, however, dampens the bullish sentiment as the options become less sensitive to changes in the underlying asset’s price as expiration approaches.

Overall, while gamma and Vanna contribute to the bullish momentum, the negative charm suggests that the bullish trend might lose steam as expiration approaches, potentially leading to a slowdown or reversal in the upward price movement.

Scenario 4: Downward Price Movement

Downward Price Movement with Negative Gamma and Negative Vanna, Positive Charm:

As the underlying asset’s price decreases, negative gamma causes call options to become less sensitive to the price movement, leading to a decrease in option prices.

Negative Vanna further exacerbates this effect, as changes in volatility now contribute to a decrease in option prices.

Positive charm, however, adds to the bearish sentiment as the options become more sensitive to changes in the underlying asset’s price as expiration approaches.

Overall, while gamma and Vanna contribute to the bearish momentum, the positive charm suggests that the bearish trend might accelerate as expiration approaches, potentially leading to a continuation or acceleration of the downward price movement.

Scenario 5: Upward Price Movement

Upward Price Movement with Positive Gamma, Positive Vanna, and Negative Charm:

As the underlying asset’s price increases, positive gamma causes call options to become more sensitive to the price movement, leading to an increase in option prices.

Positive Vanna further amplifies this effect, as changes in volatility also contribute to an increase in option prices.

Negative charm, however, dampens the bullish sentiment as the options become less sensitive to changes in the underlying asset’s price as expiration approaches.

Overall, while gamma and Vanna contribute to the bullish momentum, the negative charm suggests that the bullish trend might lose steam as expiration approaches, potentially leading to a slowdown or reversal in the upward price movement.

Scenario 6: Downward Price Movement

Downward Price Movement with Positive Gamma, Negative Vanna, Positive Charm:

As the underlying asset’s price decreases, positive gamma causes call options to become more sensitive to the price movement, leading to a decrease in option prices.

Negative Vanna, however, dampens the effect of gamma, as changes in volatility now contribute to a decrease in option prices.

Positive charm adds to the bearish sentiment as the options become more sensitive to changes in the underlying asset’s price as expiration approaches.

Overall, while gamma contributes to the bearish momentum, the positive charm suggests that the bearish trend might accelerate as expiration approaches, potentially leading to a continuation or acceleration of the downward price movement.