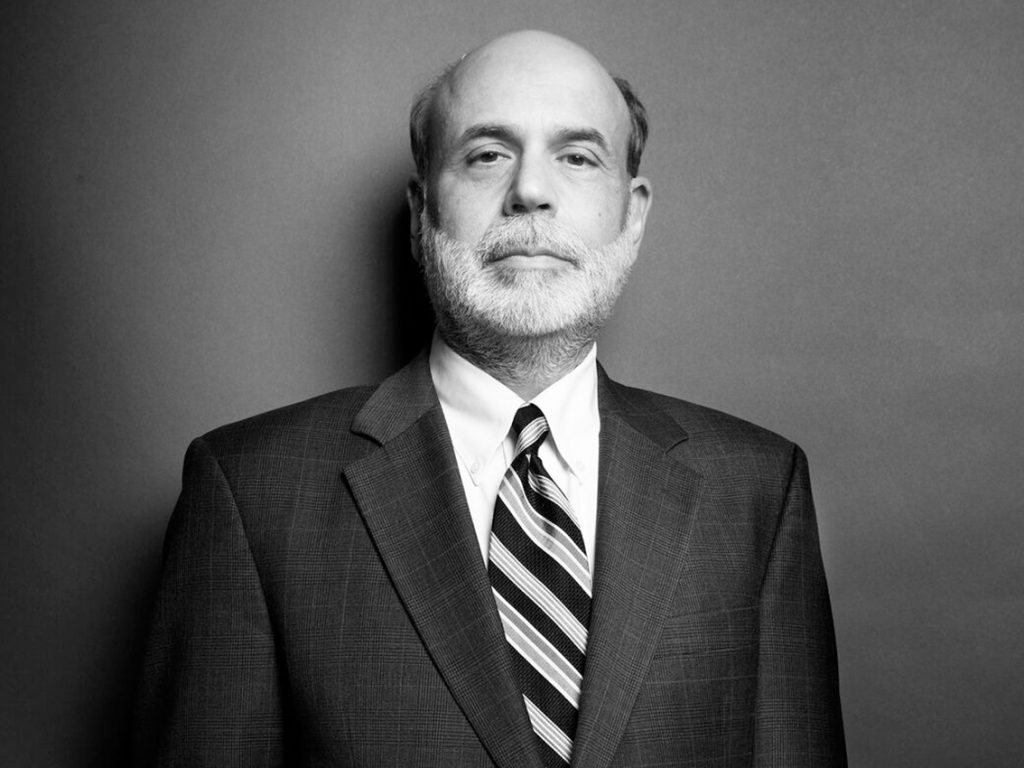

The economic crisis that occurred in 2008 was a severe and global financial crisis that impacted the United States and several other nations worldwide. The crisis led to a significant rise in unemployment, a contraction of credit markets, and a decline in asset prices. In response to the crisis, Chairman Ben Bernanke of the Federal Reserve played a critical role. He delivered a detailed analysis of the causes and consequences of the 2008 financial crisis and the tools available to the Federal Reserve to tackle such crises in his College Lecture Series titled “The Federal Reserve and the Financial Crisis.” The lecture series comprises four parts, with the third part concentrating on the role of complex securities, the collapse of Lehman Brothers, and the intervention of the Federal Reserve to prevent further crises.

Vulnerabilities:

The two main responsibilities of central banks are financial stability and economic stability. The main tool for achieving financial stability is the central bank’s lender of last resort powers, which involve providing short-term liquidity to financial institutions during a crisis. For economic stability, the principal tool is monetary policy, typically involving adjustments to short-term interest rates. During the 2008 financial crisis, the vulnerabilities were in both the private and public sectors, including excessive debt, banks’ inability to monitor risks, reliance on short-term funding, and gaps in the regulatory structure. Also, the vulnerability of government-sponsored enterprises like Fannie Mae and Freddie Mac, which operated with inadequate capital and were at risk of not being able to fulfill their guarantees in the event of mortgage losses, added more fuel to the fire.

Fannie Mae and Freddie Mac:

These entities not only sold mortgage-backed securities to investors, but also purchased large amounts of mortgage-backed securities themselves. This created additional risk, as these mortgages were vulnerable to losses and Fannie and Freddie did not have enough capital to cover potential losses. Their mortgage products and practices, such as exotic mortgages and no-doc loans, relied on ongoing increases in house prices to be repaid. These practices led many borrowers to find themselves underwater and unable to refinance when house prices stopped rising. To add more, the involvement of mortgage companies, banks, and other institutions in financing these mortgages, often by packaging them into securities and selling them off into the market, exacerbated the situation.

Collateralized debt obligations:

The complexity of the securities created during the financial crisis, particularly collateralized debt obligations (CDOs) had a risk-sealing effect. These securities combined mortgages and other types of debt and were sliced into different parts with varying levels of risk. Many investors were willing to buy them because they were given triple-A ratings by rating agencies, making them appear safe. These securities were sold to investors like pension funds, insurance companies, and even wealthy individuals, but financial institutions also retained some of them. Additionally, companies like AIG sold insurance on these securities using credit derivatives. This complex system allowed risks to be spread throughout the financial system. If we put the nature of the crisis simply, it occurred when financial institutions had illiquid assets and could not meet their short-term liabilities. The crisis of 2008, and 2009 was a financial panic but in a broader financial market setting, rather than just within the banking system.

Uncertainty:

While the actual losses from subprime mortgages were not very large, the problem arose from the complexity of the securities and the uncertainty surrounding their distribution and who would bear the losses. This uncertainty created a lot of instability in the financial markets, leading to runs on short-term funding and massive pressure on key financial institutions. Some key events of this period were the sale of Bear Stearns to JP Morgan with Fed assistance, the insolvency of Fannie Mae and Freddie Mac, the bankruptcy of Lehman Brothers, and the acquisition of Merrill Lynch by Bank of America.

The remnants of Great Depression:

A series of events occurred during the financial crisis, including the acquisition of troubled companies like AIG, Washington Mutual, and Wachovia by larger financial institutions. This crisis was not limited to small banks but affected the biggest international financial institutions as well. When the GFC happened, the Fed had its lessons learned from the Great Depression, which included the importance of stabilizing the banking system and implementing accommodative monetary policy. At the time, significant international cooperation took place, particularly during a meeting of the G7 countries, where measures were discussed to prevent the failure of systemically important financial institutions, restore confidence, and normalize credit markets.

New Fed programs:

The loss of confidence among banks in 2007 had an impact on lending rates and the overall stability of the financial system. The spike in interbank market rates following the collapse of Bear Sterns demonstrated the lack of trust between financial institutions. To address that, there was a need for the Fed to go beyond its usual lender-of-last resort facility, the discount window, and create additional programs to support various types of financial institutions. These programs aimed to enhance stability and restore credit flows in the system.

Injecting liquidity:

Because of the financial problems faced by broker-dealer institutions during the financial crisis, such as Bear Stearns, Lehman Brothers, Merrill Lynch, Goldman Sachs, and Morgan Stanley, the Federal Reserve provided short-term lending to these firms, as well as assistance to commercial paper borrowers, money market funds, and the asset-backed securities market. The Fed invoked emergency authorities under section 13(3) of the Federal Reserve Act to lend to entities other than banks, which hadn’t been done since the 1930s. Money market funds, which serve as investment funds that invest in short-term liquid assets, are not insured, but investors expect to be able to withdraw their money dollar for dollar at any time.

As the money market funds faced runs, they started selling off commercial paper, causing a shock in that market. The Federal Reserve responded by establishing special programs to restore confidence in the commercial paper market. They acted as backstop lenders, reassuring lenders that they would be there to back them up if they had trouble rolling over funds. The Fed’s actions successfully restored confidence, as seen by the decrease in commercial paper rates in early 2009.

85B$ to AIG:

The intervention of the Federal Reserve in preventing the collapse of AIG during the financial crisis was a necessity. AIG, being interconnected with both the US and European financial systems, was a critical element in the global financial system. The Federal Reserve used AIG’s collateral to provide a loan of $85 billion to keep it afloat. This intervention, along with the assistance provided by the Treasury, was controversial but necessary to prevent further crises. The consequences of the crisis and the collapse of big financial firms would have had serious collateral consequences, even though the total meltdown was prevented.

85B$ to AIG:

The financial crisis had a huge impact on both the US and global economies. The US GDP fell over 5%, leading to a deep recession and 8.5 million job losses. The crisis was not isolated to the US, as many countries worldwide saw worse declines, especially those reliant on international trade. Fears of a second Great Depression were very real, but the forceful policy response that stabilized the financial system in 2008 and 2009 prevented a much worse outcome.

Bonus:

The lecture itself contains more information about banking and historical responses to financial crises, so we suggest you watch it if you can.