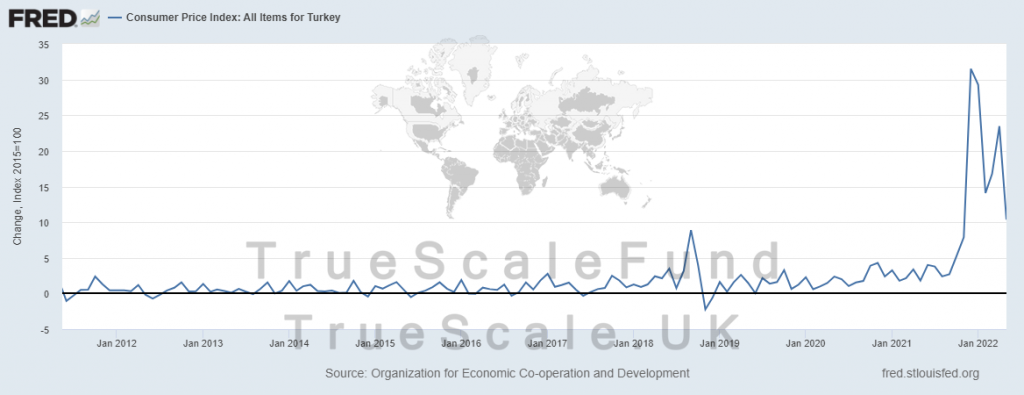

In the end days of 2021, Turkey managed to crush the USD/TRY exchange rate by 45% but so far is unsuccessful in taming the inflation. This happened again, yesterday, on a smaller scale and USD/TRY fell from 17.30 to 16.50.

What happened in December 2021?

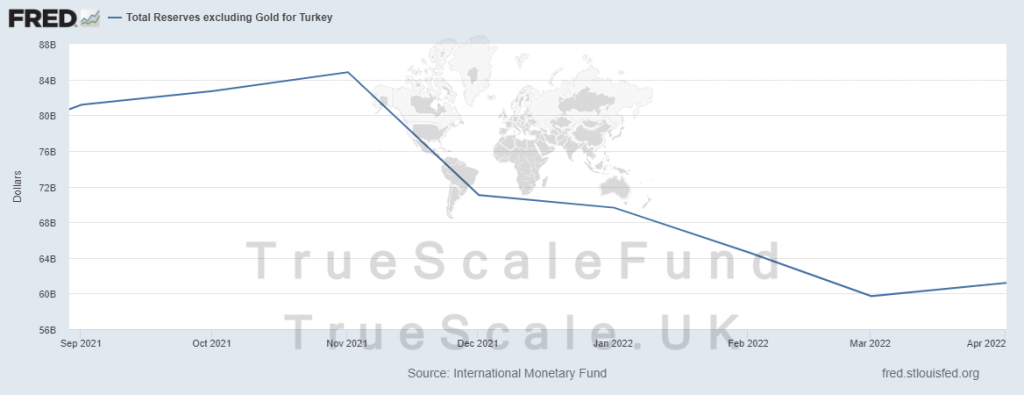

In December 2021, CBRT decided to conduct a special economic operation with the help of Turkey’s president to lower the exchange rate. With little to no liquidity in the market and a lack of active traders, as a result of being at the end of the year, CBRT decided to literally dump over 20B$ worth of foreign reserves in the market to kick the short-term speculators out of the positions and discourage them from spread-betting on the Lira.

The slaughter of speculators would not be this effective without the president giving a speech on the new bank deposit scheme which compensates depositors’ purchasing power as a consequence of the depreciating Lira.

Bad policies are the reason behind Lira’s fall

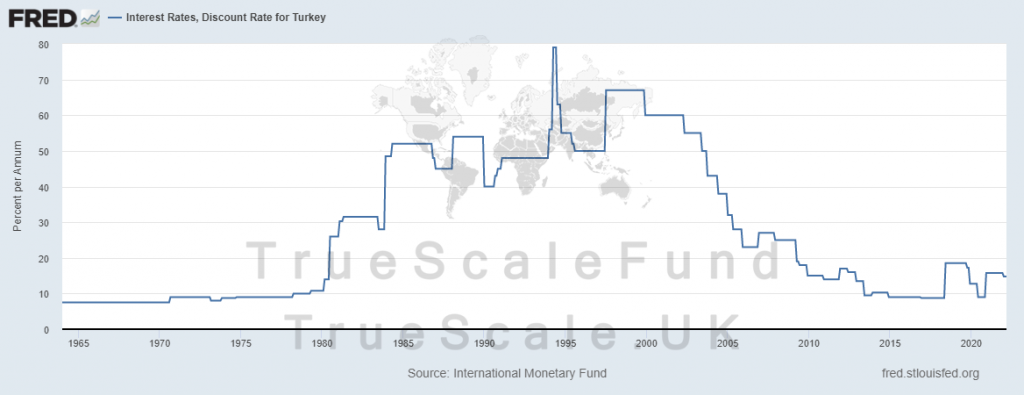

Turkey’s current president has forced its Central Bankers (plural because most of them got fired!) to decrease the interest rate to please his religious beliefs. In a functioning economy, the interest rate is the tool of CB to cool down an overheating economy. When CBs start to cut rate, they make borrowing cheaper, inflating the money supply and as a result, inflaming inflation.

Not Seasonally Adjusted

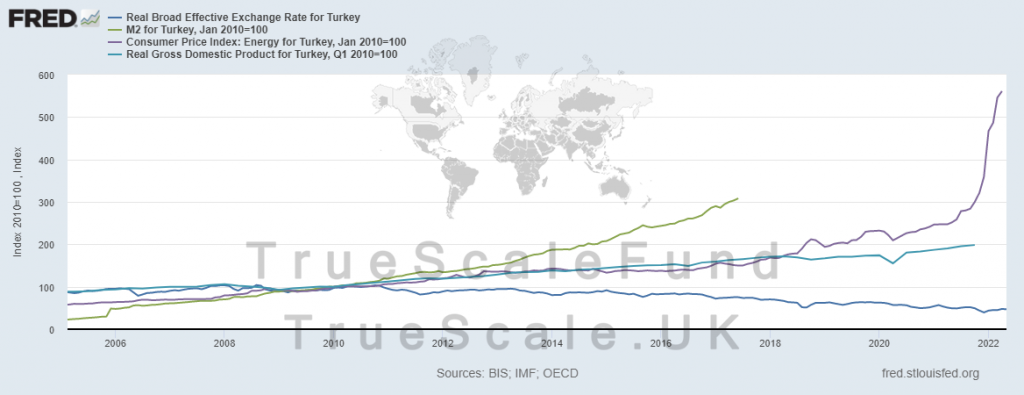

Turkey has stopped providing some monetary reports a long time ago (managing inflation expectation/panic) but we can still substitute some data for another. In the chart below, CPI for energy is a good nominee for real assumed CPI (M2 multiplied by currency circulation velocity divided by real GDP).

To put it simply, cutting interest rates in Turkey had no achievement other than inflating the money supply and diminishing the credibility of CBRT, and the credibility of a Central Bank is its ultimate tool (Venezuela’s CB note is worthless). With the rising cost of imported goods and commodities, there is no escape for Turkey. Either they have to raise the price of exported goods and lose their competitive edge or need to revise their monetary policy and hike the interest rate, which in both scenarios will cause massive unemployment and recession.