The economic crisis that occurred in 2008 was a severe and global financial crisis that impacted the United States and several other nations worldwide. The crisis led to a significant rise in unemployment, a contraction of credit markets, and a decline in asset prices. In response to the crisis, Chairman Ben Bernanke of the Federal Reserve played a critical role. He delivered a detailed analysis of the causes and consequences of the 2008 financial crisis and the tools available to the Federal Reserve to tackle such crises in his College Lecture Series titled “The Federal Reserve and the Financial Crisis.” The lecture series comprises four parts, with the fourth part concentrating on the post-financial crisis actions, highlighting collaborative efforts, stress tests, unconventional measures, ongoing strengthening, and central banks’ crucial role.

Financial institutions stress test:

Chairman Bernanke mentions the importance of stress testing in restoring confidence in the banking sector after the financial crisis. From his point of view, stress tests confirm the banks’ ability to survive worse economic conditions, which allows them to raise private capital and replace government capital. He also mentions that stress testing has continued and the banks have raised a significant amount of capital since 2009, putting them in a stronger position than before the crisis. In addition, Chairman Bernanke discusses the lender of last resort programs, highlighting their effectiveness in restoring market functioning and preventing runs on financial institutions. He explains that these programs were primarily phased out by March 2010 and that the risks taken by the Federal Reserve were minimal, with all loans being paid back.

FOMC voting explained:

Chairman Bernanke explains the voting structure within the Federal Reserve and how it influences monetary policy decisions. There are 19 individuals involved in the discussions, including the seven members of the Board of Governors and the 12 presidents of the Reserve Banks. However, only 12 people can vote in each meeting, which includes the Board members and the president of the New York Federal Reserve Bank. The other Reserve Bank presidents rotate voting rights throughout the year. Chairman Bernanke then discusses the federal funds rate and its changes over time, highlighting the shift to cutting interest rates in 2007 due to emerging problems in the subprime mortgage market. By December 2008, the federal funds rate had been reduced to almost zero, and conventional monetary policy options were exhausted. As a result, the Fed turned to unconventional measures such as large-scale asset purchases, also known as quantitative easing (QE), to support the economy. These purchases included Treasury and mortgage-related securities, ultimately increasing the Fed’s balance sheet by over $2 trillion.

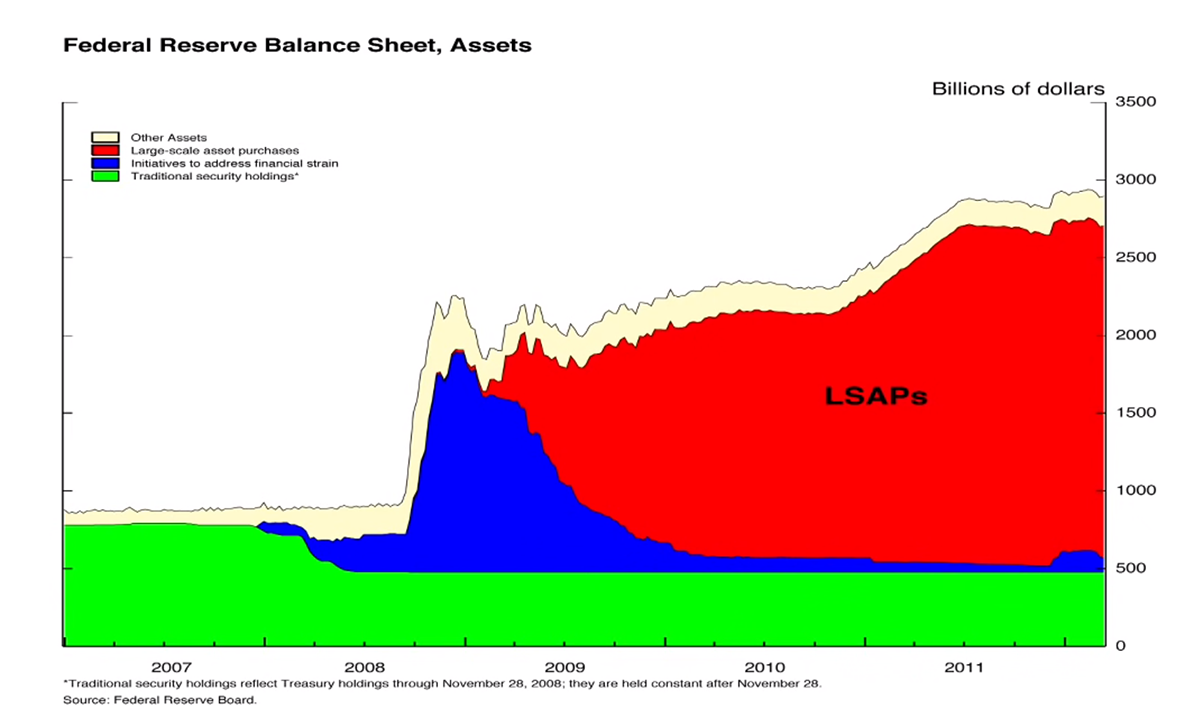

LSAP (QE):

Bernanke explains the effects of the large-scale asset purchases made by the Federal Reserve during the financial crisis. He shows a graph depicting the Fed’s balance sheet, with the green representing their traditional securities holdings, the dark blue representing assets acquired or loans made during the crisis, and the red representing the $2 trillion in new securities added to the balance sheet starting in early 2009. He explains that the purpose of buying these securities was to reduce the available supply in the market, therefore lowering interest rates and stimulating the economy. He also clarifies that the Fed paid for these securities by crediting the bank accounts of the sellers, which showed up as reserves banks held with the Fed.

Inflation, deflation, and Japanization of the economy:

Bernanke explains the impact of the Federal Reserve’s actions on interest rates and inflation. He states that the main objective of their actions was to lower interest rates, which has been successful in various sectors, such as corporate credit and mortgage rates. This has helped promote economic growth and recovery. He also emphasizes the importance of low inflation and how the Fed has been successful in keeping inflation low and stable. By preventing negative inflation or deflation, the Fed has guarded against the risks that Japan has faced in its economy for many years.

LSAP (QE) is not spending money:

Bernanke explains the distinction between monetary and fiscal policy, emphasizing that when the Fed buys assets as part of LSAP or QE programs, it is not a form of government spending. Instead, it is an investment that will eventually be sold back to the market, resulting in earned profits. He highlights that the Fed has transferred about $200 billion in profits to the Treasury, contributing to reducing the deficit. Bernanke also discusses the importance of clear communication about monetary policy to enhance its effectiveness. He shares examples such as giving press conferences, providing a numerical definition of price stability (2 percent inflation), and offering guidance on future interest rate expectations.

Credit and consumer behavior:

Bernanke discusses the implications of the housing market decline and the impact of the financial crisis on credit markets. He explains that tighter conditions in obtaining mortgages and declining house prices have led to excess supply in the market and cautious consumer behavior. Additionally, he highlights the importance of small businesses and their difficulty in accessing credit, which has contributed to slower job creation. Bernanke also mentions the European situation and its effects on risk aversion and volatility in the financial markets. He concludes by emphasizing that while monetary policy can stimulate the economy, other policies such as fiscal and housing policies are needed to address structural issues and achieve long-term economic recovery.

US financial outlook before and after GFC:

Chairman Bernanke discusses the challenges the United States faced before and during the financial crisis, including long-term unemployment and federal budget deficits. However, he also points out the strengths of the US economy, such as its diverse industries, entrepreneurial culture, flexible labor and capital markets, and technological advancements. He emphasizes that the economy has faced and recovered from previous shocks and highlights the importance of research and development for ongoing growth and innovation.

Dodd-Frank Act:

Bernanke discusses the vulnerabilities in the financial system that led to the financial crisis and the measures taken to address them through the Dodd-Frank Act. One of the main themes of the Act is the creation of a systemic approach, where regulators look at the entire financial system rather than just individual components. The Act establishes the Financial Stability Oversight Council, of which the Fed is a member, to coordinate and discuss ways to avoid problems in the system. Additionally, regulators now have a responsibility to consider the broad systemic implications of their actions. The Act also addresses the issue of too big to fail by implementing stricter supervision and regulation for systemically important institutions. These firms will face higher capital requirements, restrictions on risky activities, and regular stress tests to ensure their resilience to shocks. However, solving the too-big-to-fail problem ultimately requires making it safe for large firms to fail.

FDIC’s role:

Bernanke discusses the “orderly liquidation authority” given to the FDIC to handle failing banks, similar to how the FDIC can quickly shut down a failing bank and protect depositors. The FDIC will now have the authority to do the same for large complex firms, in cooperation with the Fed and regulators from other countries. This cooperation aims to safely wind down insolvent firms and ultimately eliminate the “too big to fail” problem. The Dodd-Frank Act also includes measures to increase transparency and regulate derivatives, as well as create the Consumer Financial Protection Bureau to protect consumers in their financial dealings.

Central Bank’s role:

Bernanke emphasizes the need for central banks to serve as lenders of last resort and use monetary policy to enhance economic stability. He acknowledges that the tools of central banks were not used appropriately during the Great Depression but commends the actions taken by the Fed and other central banks during the recent financial crisis. While a new regulatory framework is helpful, Bernanke emphasizes the ongoing need for regulators to monitor the financial system and respond to problems using the tools available.

Final notes:

Bernanke discusses the tools that the Federal Reserve has to tighten monetary policy. He mentions that one tool is to raise the interest rate on reserves that banks hold with the Fed, which would incentivize banks to keep the reserves rather than lend them out, thus raising interest rates and tightening monetary policy. He also mentions draining tools, which involve replacing reserves in the banking system with other liabilities, and the option to let assets run off or sell them. Monetary policy is powerful but cannot solve all structural problems, such as housing and financial markets. He mentions that the Federal Reserve staff wrote a white paper analyzing issues in the housing market and suggests that Congress and other agencies should determine the recommendations.

Bonus:

The lecture itself contains more information about banking and historical responses to financial crises, so we suggest you watch it if you can.