At its inception, particularly with Bitcoin, Crypto held the promise of thwarting greedy bankers and preventing bailouts of large corporations. However, after 15 years, it has become increasingly evident that this industry has been hijacked. Today, the crypto industry is witnessing an explosion in the number of cryptocurrencies, each promising exponential returns to investors based on fictional narratives, only to disappear after grabbing their money.

This cannot be accomplished single-handedly. There are people behind these schemes, creating scenarios, content, images, podcasts, and videos to lure people in with the promise of phenomenal returns on their investments. The manipulation of the crypto market and luring investors has evolved into a highly organized effort.

The rise of shady, unregulated, and opaque exchanges, has led to many losing their crypto investments in platforms such as MT.GOX, FTX, and the list goes on. However, it did not stop investors from piling into crypto. The demand was high and this caught the eyes of a few.

The rise of fake liquidity

Crypto exchange bankruptcies are a story of the past Tether era (except FTX which was founded to intentionally go bankrupt). With the help of a counterfeit USD token, Tether managed to save Bitfinix, its founder, and also take control of the market and soon become the biggest market participant. This was not a mere overnight invention, but a calculated ploy by team Russia to test the water. So, if you look back, the 2017 Bitcoin exploding north of 19K$ was a test to see how far we can go without de-pegging the fake USD token. Then the team China joins the game and starts to mine so they can increase the share of the team from cryptocurrencies. This helped them a lot to influence and stabilize the market for USDT and its price.

The Influencer

To enhance Tether’s potential, the team employed two methods, namely increasing market participants and variety of goods. To achieve the first one, they paid influencers and even found people around the world to become influencers and tell people about crypto and why they need to buy it otherwise they will lose a lifetime opportunity. This strategy significantly boosted demand for cryptocurrencies. At that point, there were many coins each promising to improve different industries and people’s aspects of life. To let people in, they helped a few start crypto exchanges around the world with the help of Tether’s printing press. This way real USD liquidity can flow from the US to Russia and China. Nowadays, if you open your Twitter app, you can see how much investment has been made to create bots, half of them are shilling crypto, and the other half are spreading misinformation, liking and retweeting apologists’ posts, and promoting hashtags that seek to influence people’s political opinion. At this point, we would not blame anyone who says Elon Musk intentionally bought Twitter to let these bots continue their activity and thrive, since it has become obvious that Twitter is doing the bare minimum to stop bot activities asserting that they do not have enough funds to allocate. However, it is ridiculously simple and easy to spot bots and ban them from the platform.

The creator despite his creation, China and Russia ban on crypto

According to Cointelegraph, Cryptocurrency usage in Russia faces restrictions due to legislation, including Putin’s 2020 law legalizing but banning crypto use for goods. A 2022 bill, at odds with the Bank of Russia, treats crypto as an investment tool, not legal tender. It proposes fines of up to 500,000 rubles for individuals and 1 million rubles for companies engaged in crypto trading or issuance. This is solely has been done to ensure that Russia is the only one who can suck USD in from other parts of the world.

In another section of Cointelegraph, you can read about China. Despite its hardline stance on cryptocurrencies and banning them, China is actively pursuing blockchain technology adoption across various sectors, including finance, supply chain, and urban planning. China wants to internationalize its currency and lessen reliance on the United States dollar in international trade and finance, and its CBDC, the digital yuan, is a component of that effort.

What went wrong?

Securities and Exchange Commission was sleeping behind the wheel. When FTX and Binance US were in the business of transferring cash from their US customers to Russia and China, the SEC did not prevent banks from transferring these funds offshore. in addition, they did not take any measures to regulate exchanges until it was too late. The huge portion of customers’ money lost in FTX, has contributed to keeping Russia’s war machine running in different parts of the planet and provided liquidity for drug smuggling to the US. The hidden damage is where to cope with these threats, the US has to print USD and send it overseas, catch smugglers, and provide more social benefits to support those who are infested with drug abuse and so on! So, it seems like owning crypto is like shooting yourself in the head multiple times. With each dollar invested in the industry, has contributed to increasing destruction and pain in the free world. So what can we do?

Do not boycott, be smart

There are certain solutions to reduce the crypto hijackers’ potential to use your money to fund their illicit activities if you live in the US or Europe:

- Do not invest in any project or coin which is new. Better be late than dead. If a project is potentially viable, you will be able to buy after a few years when the price dips. look at the price of bitcoin, there was always time to buy.

- Avoid trading cryptocurrencies in synthetic futures or CFD contracts. These markets are intentionally structured in a way to ensure you lose your money, and all of those lost funds are being used to make the world a worse place.

- Do not buy coins from unregulated suppliers. Always try to find a local source. A friend or a miner.

- Do not buy at tops and Hold to a losing position. If it is too late to enter the market, let the price run. You can consider buying it again in a few years.

- If you are in profit, take your initial investment off the table.

- Always keep your coins in your wallet and transfer them as soon as you purchase them to ensure security and control over your assets.

- Do not invest in Third party projects to harvest yields. Those projects are designed to vacuum money like Celsius which worked as a blackhole to drain liquidity.

- Do not use Centralized USD tokens. If you own USDT, you are intentionally or unintentionally providing legitimacy and liquidity to shady participants. Demand cash in your bank account and settle for nothing else.

- Unfollow Crypto influencers; you have to take control of your life and not let anyone influence your decisions and to do so you need to gather data and decide based on that.

- Stop providing USDC liquidity on defi projects. By doing so, you are stabilizing criminal’s counterfeit USD. This is not different from financing crime.

Bonus: What does data say about the Crypto’s future?

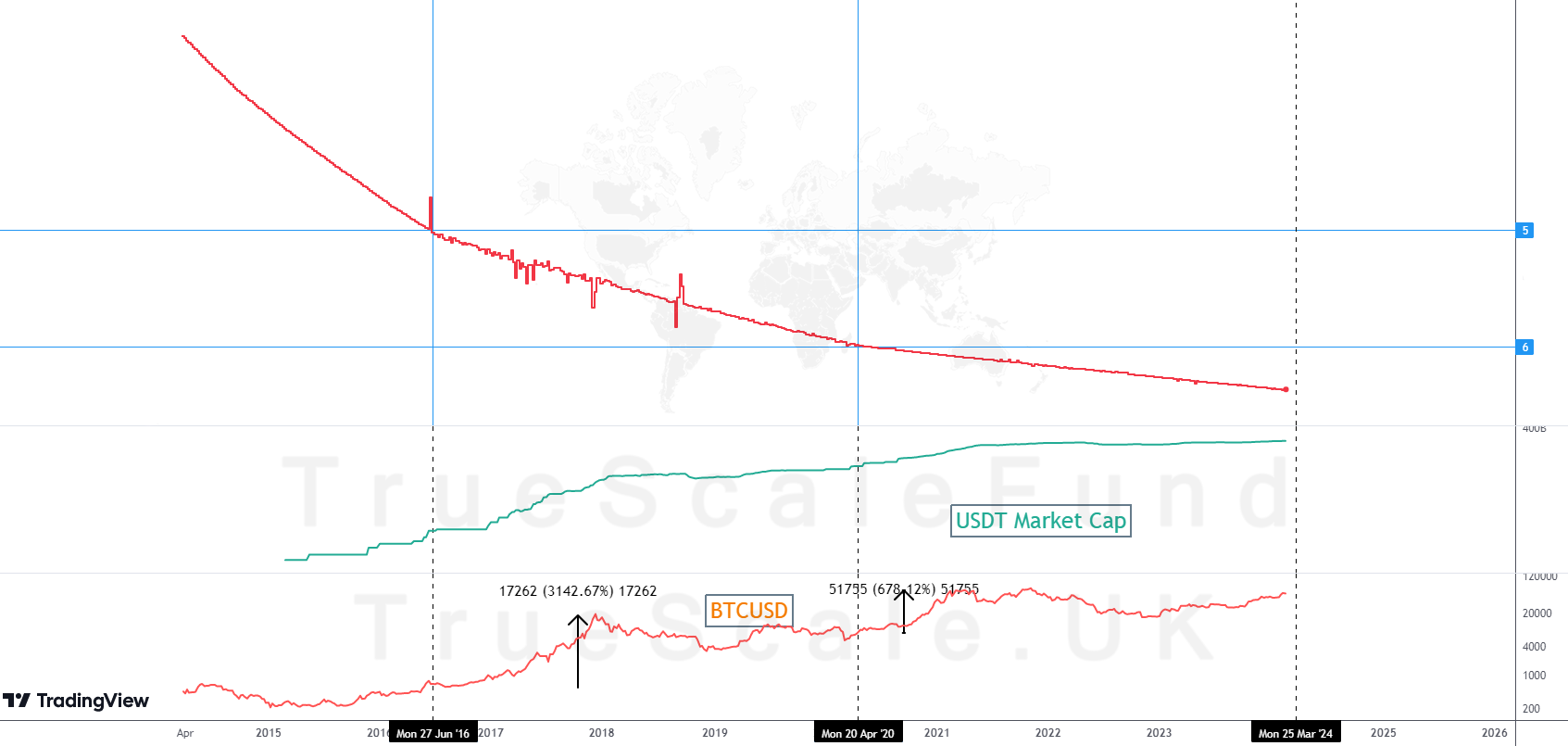

To analyze the crypto market, we have developed many tools to show the current, past, and expected performance of each coin. As you can see in the chart above, the performance of Bitcoin has been falling since June 2016, When Tether started to flood the market with its fake USD. The second decrease in Bitcoin performance happened in April 2020, after Tether started to print again. We are near the third phase of the Tether printer going loose and killing BTC’s efficiency. The first time the price rose by 31X, the second time rose by 6.5X and the third time it will be less than that. Additionally, should performance decline by 1 unit, the subsequent rally is expected to be approximately one-fifth of the preceding one. Based on our data, we advise you to not seek a 10X return and cash out your initial investment. The promises made by some to push the price near 1M$ are not supported by data. Remember the HODL is a strategy developed to make you feel less bad about losing money in crypto when the price drops. You can access the data above and many more from here (optional). We have put thousands of hours into developing these data-driven indicators, and we are certain that this bull run is not going to be greater than a 3 to 1.5X return, and sure everyone gonna blame ETFs for that.

Bonus: The US is winning the Crypto game

The recent measures to legalize the crypto industry such as approving Bitcoin ETFs, fining Binance, Cutting Binance US from the US banking system, and putting pressure on exchanges to delist privacy coins, helped to change the tide.

Even the basic charts suggest that Tether is losing its steam and will not be a part of the crypto ecosystem. for example, the chart below shows the dominance of USDT divided by the dominance of USDC suggesting that market participants are awakening to the fact that Tether is not backed by enough USD or its equivalent.

Market dynamics don’t occur in isolation. As Tether reduces its supply, the Venezuelan bolivar sees a significant devaluation, while Tether’s printing tends to put a brake on the USD rally.

Help to spread the word

Those who will lose money after the next bull run are primarily:

- USDT (Tether) holders

- People who believed in the promise of higher prices and did not cash out

- Investors in meme coins

- Those who bought coins at the tops

- people who keep their money on central exchanges

- CFD and Future traders

Share this with your friends and let them know you care about their financial success. We believe You can play a role in making the world a better place while enjoying your crypto investment.