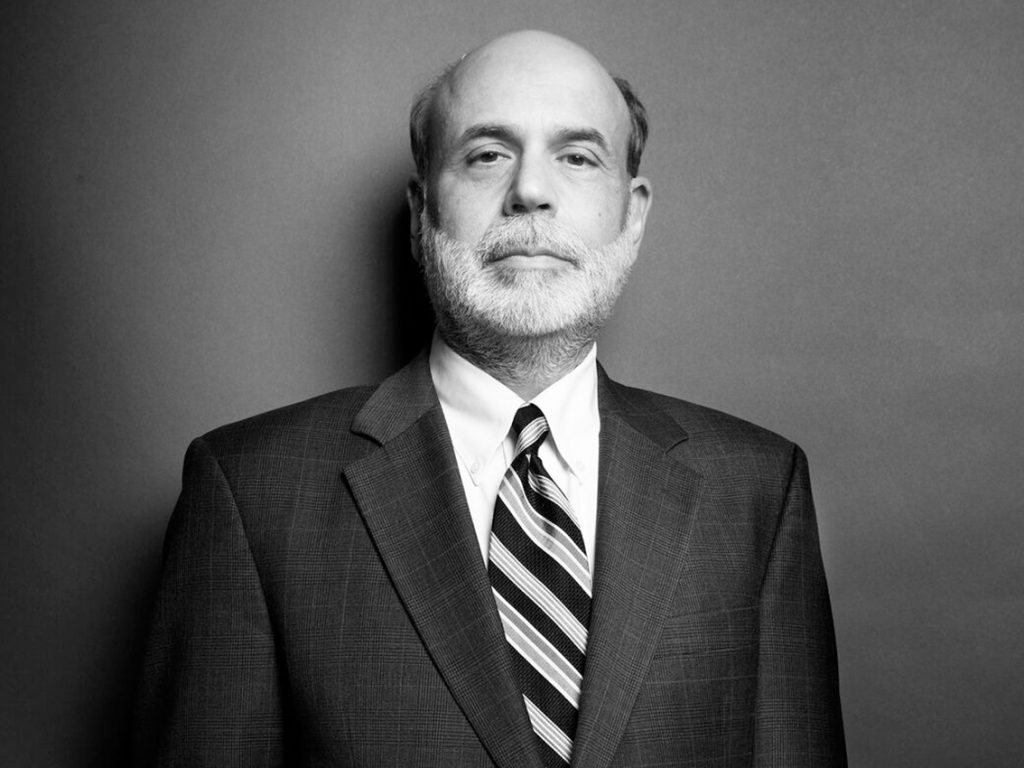

The economic crisis that occurred in 2008 was a severe and global financial crisis that impacted the United States and several other nations worldwide. The crisis led to a significant rise in unemployment, a contraction of credit markets, and a decline in asset prices. In response to the crisis, Chairman Ben Bernanke of the Federal Reserve played a critical role. He delivered a detailed analysis of the causes and consequences of the 2008 financial crisis and the tools available to the Federal Reserve to tackle such crises in his College Lecture Series titled “The Federal Reserve and the Financial Crisis.” The lecture series comprises four parts, with the first part concentrating on historical banking crises and the actions taken to address them. This article provides an overview of Bernanke’s lecture, with a particular emphasis on his observations regarding historical banking crises, responses, and consequences based on his viewpoint.

Central Bank:

Bernanke introduces the topic of the Federal Reserve and its role in macroeconomic and financial stability. He explains that a central bank is a government agency that stands at the center of the monetary and financial system of a country. He discusses the two broad aspects of what a central bank does, which is to achieve macroeconomic stability and financial stability. Bernanke also explains the two sets of tools the central bank uses: monetary policy for economic stability and a range of measures to manage the financial system for financial stability.

The tools of Central Banks:

Bernanke explains the three main tools used by central banks to maintain financial stability. The first is monetary policy, which involves raising interest rates to slow down the economy and reduce overheating. The second is a tool used during financial crises, known as the lender of last resort, which involves providing liquidity through short-term loans to financial institutions. Lastly, central banks are responsible for financial regulation and supervision to keep the financial system healthy and mitigate the risk of a financial crisis occurring. Bernanke also provides a brief history of central banking, mentioning the Bank of England’s significant role in setting the pace and practices that are still used today.

The root of financial panic:

Bernanke explains what a financial panic is and how it can lead to a crash in the economy. He gives an example of a bank run and explains how people pull their money out upon hearing of a rumor to avoid being left with nothing. As a result, the bank would be forced to sell its loans at a discount, and beyond that, the panic can spread to other markets such as stock markets. He further added that a lender of last resort is the basic tool to deal with the situation.

The role of Central Bank in financial panic:

Bernanke explains the role of the central bank in providing financial stability, particularly during a banking panic. During a crisis, the central bank acts as a lender of last resort by providing short-term loans against collateral, mostly the illiquid assets of an institution. This can help quell a run, pay off short-term lenders and depositors, and calm the situation. If this source of funds or lender of last resort activity is absent, many institutions may have to close their doors or go bankrupt, which could create problems and spread panic throughout the banking system. The Bank of England figured this out early, and Walter Bagehot, a journalist, provided a dictum that dictated central banks during a panic should lend freely to whoever comes to their door as long as they have collateral.

History of financial crises:

Bernanke discusses the history of financial crises in the United States and how private clearinghouses attempted to stabilize the banking system. However, these private arrangements were insufficient because they lacked the resources and credibility of an independent central bank. Financial panics were a major issue, with more than 500 banks failing during the severe financial panic of 1893. Congress recognized the need for a central bank after the banking crisis of 1907, and a 23-volume study on central banking practices was prepared before the Federal Reserve’s establishment. The other major mission of central banks is economic stability, and in the United States, a gold standard was used in the late 19th and early 20th centuries to help set the money supply and price level in the economy.

Problems with the gold standard:

Bernanke discusses the drawbacks and concerns associated with the gold standard. One major issue is the effect of the gold standard on the money supply, as it does not allow for much scope for a central bank to use monetary policy for stabilizing the economy. This means that there is no flexibility for central banks to lower or raise interest rates, which often causes volatility in the economy. Additionally, under a gold standard, there is a fixed exchange rate between currencies of countries, which can result in the transmission of both good and bad policies between countries and takes away the independence that individual countries have to manage their own monetary policy. Finally, speculative attacks can happen as central banks with a gold standard only keep a fraction of the gold necessary to back the entire money supply.

He also mentioned the issues surrounding the gold standard, citing the 1931 attack on the British pound to show how speculation could cause a run on the bank. He also discusses the financial panics associated with the gold standard and explains how it did not always ensure financial stability. Furthermore, the gold standard often caused deflation, which especially impacted farmers who were squeezed as crop prices fell but their debt payments remained unchanged. William Jennings Bryan ran for president with a primary goal to modify the gold standard in order to add silver to the metallic system and bring more money into circulation to address the deflation issues it caused.

The motivation behind the Fed establishment:

Bernanke discusses the motivation behind the founding of the Federal Reserve and why previous attempts at creating a central bank failed. He highlights the two main objectives of the Fed, which were to act as a lender of last resort and to manage the gold standard, in order to stabilize interest rates and other macroeconomic variables. Woodrow Wilson’s approach was considered successful as he created 12 Federal Reserve banks across the country, ensuring that each region had a voice in Washington, D.C., where the Board of Governors oversaw the whole system. The Roaring Twenties was a period of great prosperity in the United States, during which the Fed was able to establish its procedures before being hit by the first great challenge in 1929.

The Great Depression of 1929:

Bernanke mentions the Great Depression, a global phenomenon that saw the U.S. stock market crash in 1929, triggering a decline of 85% in stock prices by mid-1932. The real economy also suffered greatly, with GDP contracting by large amounts every year from 1930 to 1933, and prices falling by about 10% in 1931 and 1932. These factors led to an enormous rise in unemployment, which peaked at close to 25% in the early 1930s. The Great Depression was caused by many different factors, including repercussions of World War I, problems with the international gold standard, and the collapse of large financial institutions in Europe.

Multiple factors that led to the Great Depression, including the intellectual approach to the economy at the time, are called the liquidationist theory, which suggested that a period of deflation was necessary after a period of excess to eliminate the accumulated excesses of the economy. Bernanke also highlights the failures of the Federal Reserve during the Great Depression, both on the monetary policy side and the financial stability side. The Fed did not ease monetary policy the way it should have during the severe recession, and it did not act as a lender of last resort, which caused a tremendous decline in the banking system and the failure of almost 10,000 banks in the 1930s.

Lessons the Fed learned from the Great Depression:

Chairman Bernanke discusses how the Federal Reserve failed in its mission during the Great Depression. He notes that banks were failing, and while some were insolvent and beyond help, the Fed appeared to agree with the liquidationist theory which said to let the system contract, but this was not the right prescription. Franklin Roosevelt came into power and took a variety of different actions, but two things he did were very effective in offsetting the problems that the Fed created. First, he established deposit insurance in 1934, and second, he abandoned the gold standard, allowing monetary policy to be released which ended the deflation and led to a short-term rebound. Bernanke concludes that the policy errors in the United States and abroad played an important role in causing the global depression, and in particular, the Fed failed to use monetary policy aggressively to prevent the collapse of the economy and did not adequately perform its function as a lender of last resort.

Price bubble and going back to the Gold standard:

Chairman Bernanke discusses the regulation of asset price bubbles, specifically the importance of addressing them through financial regulatory approaches rather than just raising interest rates. He also addresses the question of returning to the gold standard, debunking the idea that it would be feasible for practical and policy reasons, and citing historical evidence that it did not work well, particularly after World War I, and was one of the main reasons for the depression being so deep and long. Bernanke emphasizes the importance of maintaining flexibility in monetary policy to respond to booms and busts.

The Fed’s response to economic data:

Chairman Bernanke discusses the double-dip recession that occurred during the Great Depression and the potential mistakes made in trying to recover from it. He explains that early interpretations suggest that the second recession was brought on by a premature tightening of monetary and fiscal policy. Bernanke emphasizes the importance of being attentive to where the economy is and not moving too quickly to reverse the policies that are helping with the recovery. He also addresses concerns about unemployment remaining high after an economic slump and the potential need for global cooperation in fixing a worldwide recession.

Central banks should Cooperate:

Chairman Bernanke discusses the lack of international cooperation amongst central banks during the Great Depression due to political tensions and the gold standard’s fixed exchange rates. He mentions that flexible exchange rates can now insulate countries from the effects of monetary policy in other countries, but emphasizes the importance of coordination amongst central banks. He concludes by thanking the audience and hinting at further discussions on central bank cooperation in his next lecture.

Bonus:

The lecture itself contains more information about banking and historical responses to financial crises, so we suggest you watch it if you can.