In this post, we explained how Tether manipulates the crypto market in its advantage and how the collapse of FTX bailed out Tether and enabled them to meet its redemptions. We post a link referring to each of our articles on our Twitter page and the amount of gaslighting that we received from Tether’s apologists and bots was astonishing.

There is no doubt that Tether Has kidnapped Satoshi’s dream for a Decentralized system of transferring value. This has convinced us that we need to dig deeper and talk about Tether’s big network of Fraud in particular its last paper fortress, Binance.

Tether and volatility:

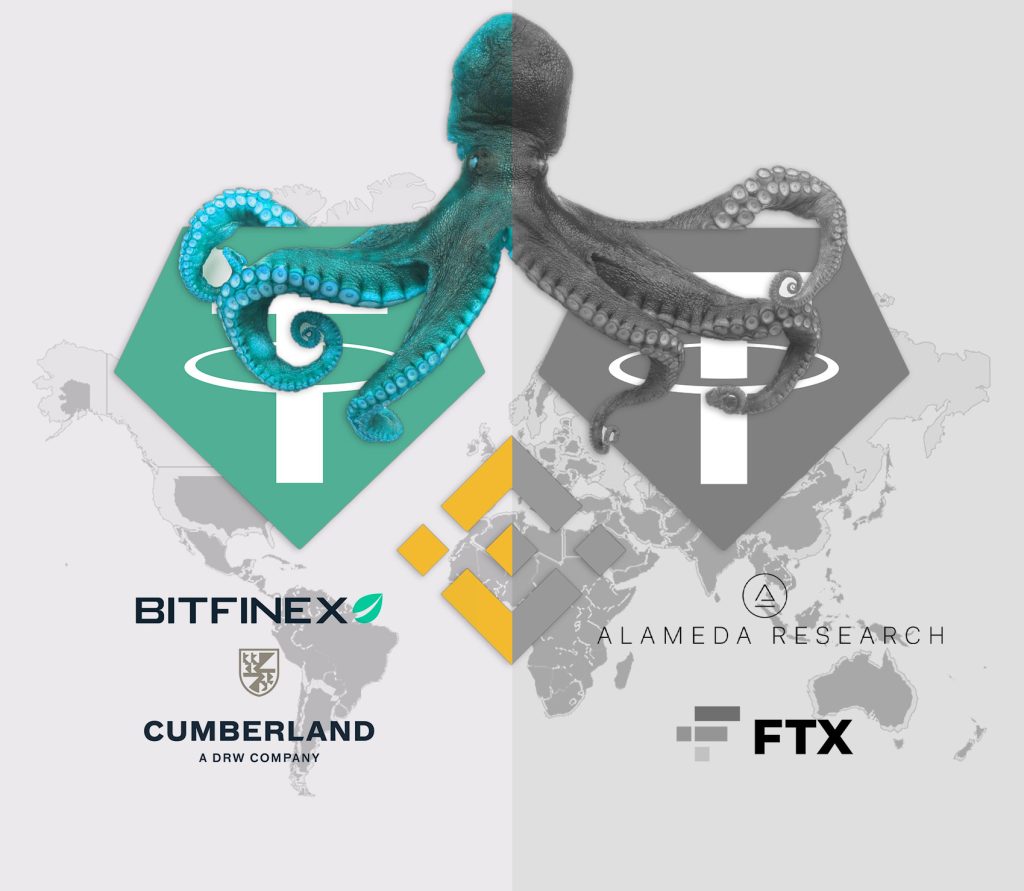

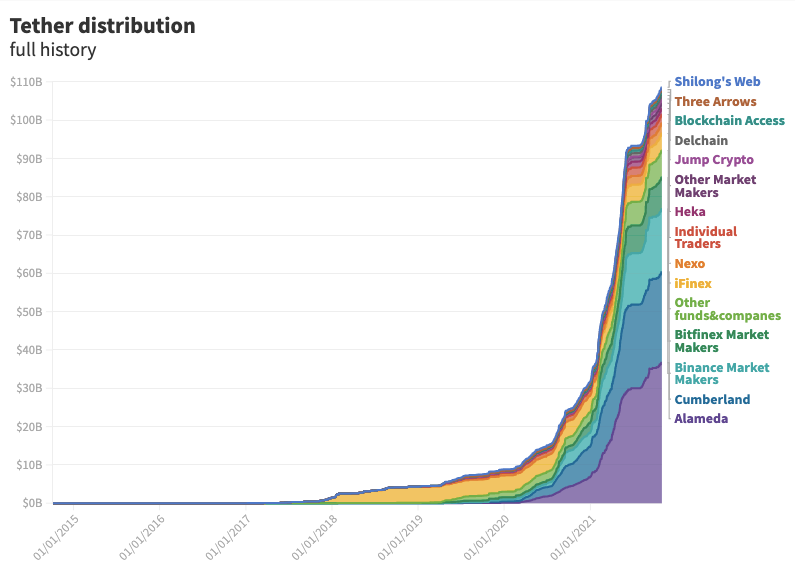

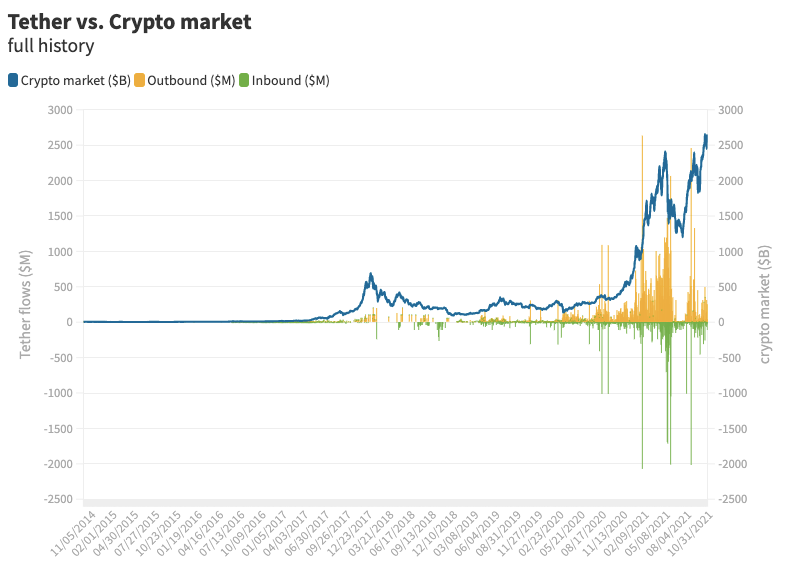

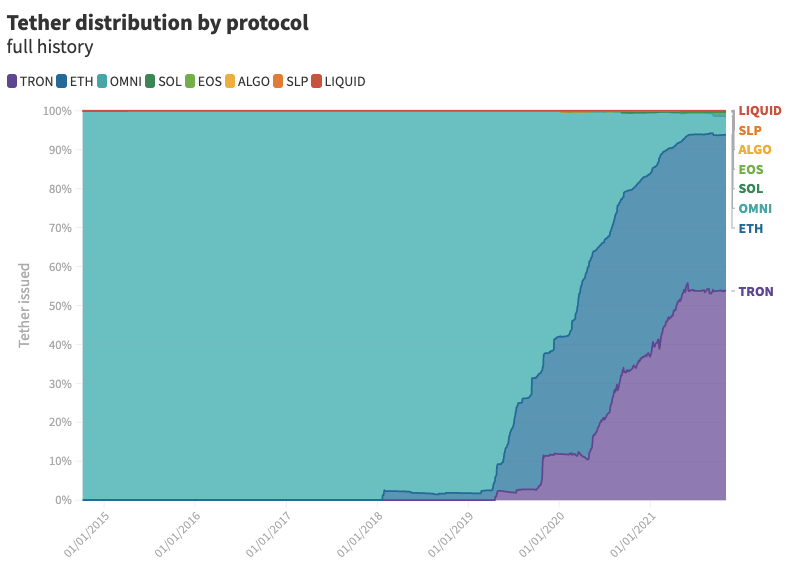

According to Tether’s paper, Tether sends a staggering majority of USDT directly to market makers and liquidity providers. FTX and Alameda were key players in how Tether USDT operates, as they were responsible for seeping roughly two-thirds of all Tether into the crypto ecosystem. The article titled “Tether Papers: This is exactly who acquired 70% of all USDT ever issued” sheds light on the dual Tether ecosystem, consisting of FTX and Alameda and Binance and Cumberland, as well as the questions surrounding who controls which chain and why. Data Finnovation sheds even clearer light on this issue and concludes that the market makers hold the USDT and are able to get relationships with banks, allowing them to maintain the peg. Binance and Cumberland run Ethereum USDT serving anywhere besides China, while FTX and Alameda run Tron USDT, focusing on China and Asia.

Tether uses exchanges and market makers like Alameda and Cumberland to increase the use case for USDT and crush the redemption requests. These exchanges also provide trading vehicles and derivatives so-called “futures trading” which let the Tether expand its supply and take other sides of speculator’s bets, manipulate the price to their advantage and not be worried about the exchange and market maker’s redemptions. Since a large portion of the crypto market’s valuation is based on Tether’s creating demand for coins and tokens via its token printer, any large redemption from market makers and exchanges that can de-peg the USDT from 1$ is a threat to the exchanges themselves. The insolvency of Tether will be followed by a plunge and deep recession in the crypto market which can eventually kill the exchanges. So, it is in the market makers’ and exchanges’ interest to not put pressure on Tether.

Together, Alameda and Cumberland received at least $60.3 billion in USDT across the time period analyzed, equal to around 55% of all outbound volume — ever. $49.2 billion (71%) of Alameda and Cumberland’s USDT was acquired in the past year alone, equal to about 60% of all Tether issued in that time.

Tether Papers

Tether and FTX:

The friendly relationship between Tether, Alameda, and FTX fell apart in May of 2022 when Terra Luna went down. FTX turned on Tether and let it de-peg to 95 cents, with over 18 billion in redemptions by June 2019. This concerned CZ and made him ask SBF to stop destabilizing the stablecoin. Before that, FTX tried to take down Celsius, which was a major investor in Tether and had loaned it billions. Many believe this was in light of FTX switching sides from the Tether to the USDC in an attempt to go more legitimate with their banking partners, but there is more to that story.

If FTX were to seek greater compliance with US law and mitigate risk in the eyes of US lawmakers and bankers, they could pursue the conversion of their Tether holdings into USDC and DAI or redeem their USDT. Nevertheless, this avenue of action was not pursued due to the mistreatment suffered by FTX. In fact, SBF appears to have established its enterprise with the knowledge that the beloved stablecoin printer, Tether, is responsible for all fluctuations in the Crypto market. With the cooperation of Tether, SBF could ascertain precisely when to buy or sell crypto assets via their sister company, Alameda, and consequently profit handsomely. SBF transferred customers’ funds from FTX to Alameda, waiting for the opportune moment to act upon Tether’s purchasing signal. In reality, they were unknowingly taking positions against Tether, which was offloading its cheaply acquired coins onto the market. By exploiting this scheme, Tether survived the post-Terra-Luna collapse, at the expense of FTX users’ funds, in collaboration with SBF.

Justin Sun’s involvement with Tether and Binance:

Justin Sun is replacing FTX on the Tron side of things. Chats from a secret Signal group show that Paulo Ardoino of Tether was freaking out about a Tether de-peg and congratulating CZ on taking down Sam. CZ appears to tell Justin Sun to take over the Tether operations, and large transfers have been happening, such as a 200 million USDT transfer from Tether to Justin Sun and then to Binance. It looks like Justin Sun, CZ, and Tether are running the largest Ponzi in history, with Bitfinex and Binance apparently colluding to manipulate the peg.

Justin Sun and CZ have a close relationship that goes back to the incubation of Tron, where Binance was used to facilitate and launch the Tron ICO in 2017, and Justin Sun’s BitTorrent was one of the first projects to do a token sale on Binance’s launchpad. Justin Sun’s history of scamming and his involvement with the Tron project and Tether is not hidden from those who do their due diligence. He whitelisted the Node Token project, which ended up being an exit scam defrauding all investors. He is already under investigation by law enforcement for potential charges related to wire fraud, money laundering, and conspiracy to defraud the United States.

Binance, a fractional reserve exchange:

Centralized exchanges, such as FTX, Mt. Gox, and Binance, are inflating the supply of Bitcoin through fractional reserve practices. However, CZ Binance is making a stand against fractional reserves, announcing that they will soon be doing Merkle-tree proof-of-reserves and publishing cold wallet addresses and balances for some of their coins. However, we express skepticism towards Binance’s claims and CZ’s reputation in the crypto industry, due to lots of criticism about their proof of reserve methods, not disclosing their liabilities, and hiding exchanges that match their trading volume in certain coins (shell exchanges) in their coin description pages.

Binance has been and is currently running on fractional reserves, despite touting full reserves and denying the practice. This includes an analysis of a November 8th tweet from CEO CZ regarding the importance of having a large reserve in light of the FTX debacle, as well as discrepancies between the balances listed on Binance’s proof of assets page and those found on block explorers.

A non-audited Centralized Exchange has some assets and lots of IOUs on its balancesheet. However, they manage to survive as long as those IOUs are not exercised.

Tether and Binance involvement in money laundering:

Binance has knowingly relaxed their anti-money laundering checks, such as KYC and AML, despite being aware of illegal activities being conducted on their exchange. Binance has been found to have acted against its own compliance department’s assessment and continued to recruit customers in rogue countries despite being identified as high risk for money laundering. The exchange has also been accused of watering down compliance rules and ignoring concerns raised by former employees about weak KYC checks. The FBI and Ukrainian authorities have recently seized nine exchange domains for money laundering allegations, including some exchanges that offered services in both English and Russian and featured a lack of AML measures, similar to Binance.

It is reported that Binance has been accused of being used by drug cartels to launder millions of dollars and for allowing dealers to operate on their exchange. Reuters found that Finance from 2017 to 2021 processed transactions totaling at least 2.35 billion stemming from hacks, investment frauds, and illegal drug sales. Additionally, if a crypto exchange or protocol is helping Rogue states move money, they are in serious trouble; the DOJ will be after them, and TRM Labs has found that most of the volume transacting in Rogue states for crypto happened on the Tron chain and BNB chain, with 90.3 percent coming from centralized exchanges, including Binance. The DOJ is already investigating illicit cryptocurrency activities, and international cooperation to identify and stop the bad actors is already happening, which could be bad news for Binance and Tron if they are aiding them. The allegations against Binance are backed up by evidence, including an article from Reuters that details how Binance created a separate entity to serve US customers while still being controlled by CZ.

Tether and invention of meme coins:

There are allegations of insider trading on Binance, including leaked messages from co-founder Yi-He about a certain crypto project in September 2017. A leaked message involving Binance’s Yi He contained insider information on the delisting of Waltoncoin (WTC) from the exchange. This information was leaked before the official announcement, leading to a drop in WTC price from $2 to $1.26 cents, raising suspicions on whether Binance is engaged in fractional reserves in the cryptosphere.

Apparently, Tether has recruited many who live in different countries to create a network of influencers. These people who speak another language besides English, are part of the Tether operation and help them to sell useless meme coins to people who can not read or speak in English. Apparently, Tether has heavily invested in these influencers and has been financing them to conduct webinars, maintain social networks and create social media content to show off their lavish lifestyle to lure people into these scam tokens. Unsurprisingly, if you search for these people online, many of them have a picture with either CZ or Justin Sun. Coincidence, maybe.

Meme Coins known as “shit coins” are type of financial vehicles for Tether to absorb liquidity from the ecosystem through Exchanges with the help of their influncer circle to cancel Tether USD IOUs and reduce the volatility of USDT.

Binance and bankruptcy:

Over the past few weeks, Binance has been besieged by a torrent of withdrawals. Despite the close familial relationship between Tether and CZ, unlike SBF, the specter of Binance’s bankruptcy was never a viable option for Tether. However, the dominos of misfortune continue to tumble, and CZ is now faced with two difficult choices. Either he must succumb and vanquish all the USDTs that must be redeemed from Tether, thus wiping out a significant portion of Tether’s debt. Alternatively, like SBF, he can turn against Tether and destabilize the USDT/USD peg. Regardless, we can already foresee the outcome of this spectacle for an exchange that lacks a physical headquarters.

All the fuss in crypto market around CZ fight with FTX founder SBF are shows to create a narrative with heros and bad guys. However, all of these work for one entity, Tether.

Conclusion:

The US lawmakers are waking up to the reality of Tether, Binance and the criminal cartel behind it, and we are going to see the whole crypto market splitting into two. One will work under the supervision of US lawmakers, and the other will be worthless unless goes through a KYC in a US-trusted exchange.

Bonus: Bitcoin will reach a 1 million dollar target, but denominated in USDT.