Years ago, Japan, a deflationary economy, decided to create inflation to incentivize exports and help local producers. To achieve this, the Bank of Japan started to inflate the money supply by buying Japan’s Government Bonds. By doing so, Japan Gov suddenly had access to literally infinite capital to throw in infrastructure projects, such as rail roads, technologies, and anything you can think of. But, all of these massive expenditures could not create inflation in japan because of a few causes.

First of all, the Japanese Yen was an attractive buy to foreign investors. Since the forex market is based on demand and supply, due to a lack of incentive to convert JPY into other currencies and a massive trade surplus with the US, JPY refused to devalue against other currencies. Next, commercial banks in Japan were unsuccessful in giving loans due to an aging population that was not in need of a new home or car. To make things worse, years of deflation had already hardwired the public’s brain to hoard cash instead of spending it on goods and services. The biggest problem here was the foreigners’ access to the JGB market. When you have a currency that keeps getting stronger and you have bonds denominated in that currency with coupons, it is not strange to see foreign investors converting their local currencies to yours to buy your bonds! And let’s face it, Japan is a small country. How much infrastructure can you make to keep feeding the economy with enough JPY?

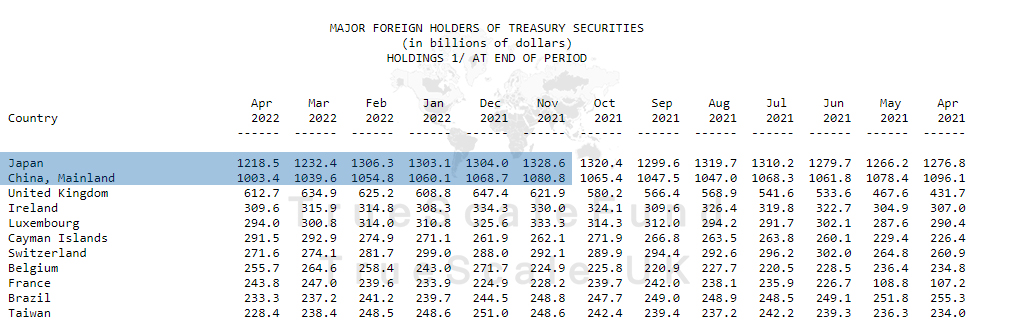

With JGB yield at its lowest, the yield starving Japanese investors started to buy US treasuries so they can earn dividends on their investment. This was the turning point for JPY as it stopped the currency from depreciating more. The country itself started to hoard UST, as they see it as a viable scheme to push the yen lower. As a result, Japan became the biggest financier of the US government and the JGB market turned into a ticking bomb.

By doing these QEs, Japan’s debt to GDP ratio has reached over 250%. In fact, it has the highest Debt to GDP ratio among all the countries which worries JGB investors if they are ever going to be paid and asking for a higher coupon on JGB. But now, the expenditure of the government is too high that it is impossible to raise rates and if they lower their expenditure, the yen will start to appreciate again.

To curb this, Japan started to control the Yield on JGBs. Now BOJ was given the green light to buy unlimited JGBs at a certain rate to stop yields from going higher.

Remember those yield starving Japanese investors? With yields suppressed at a certain level they rushed into US treasuries but since the trade deficit between the US and Japan was high enough, the Ministry of Finance managed to keep the exchange rate for JPY stable for a long time.

With the war in Ukraine and the rising price of commodities, Japan faces a dollar inflow shortage. The demand for Japanese goods is dropping and this nation that imports oil, gas, and raw materials has to pay more for them. In addition, JGB owners are exiting their positions, selling their JGB to BOJ and demanding USD.

Japan has two choices. To abandon YCC and let the rates rise, which they are not willing to do at any cost, or let the JPY depreciate. So far they have chosen the second solution, but to keep the JPY away from turning into a useless paper, they have started to sell USTs.

The main question is how much UST they can sell until the US tells them “that is it, deal with North Korea, China, and Russia all by yourself because I have a bigger fish to fry (UST market)”? that certainly is a time to short JPY.