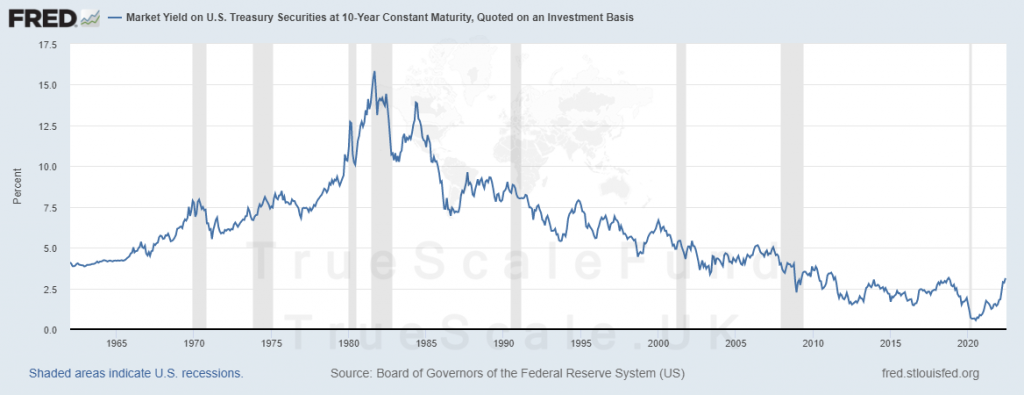

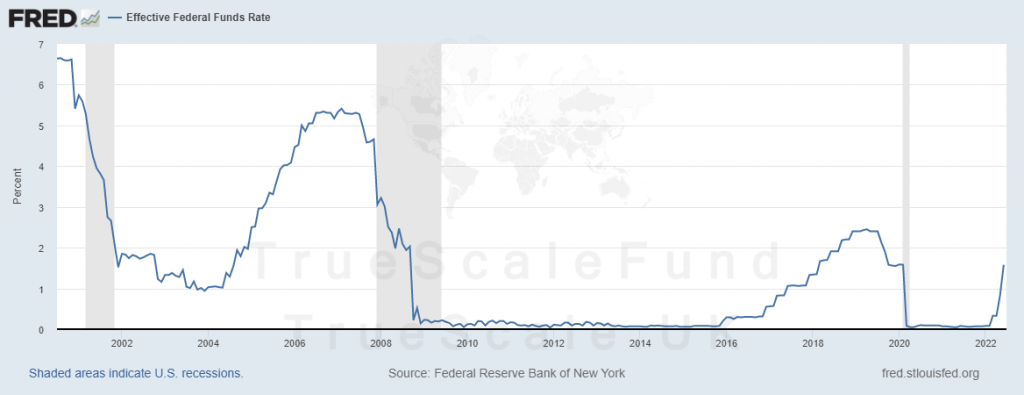

There is a new type of belief out there that assumes the Fed doesn’t need to increase interest rate because the bond market has done it for them. Let’s see how absurd this statement is.

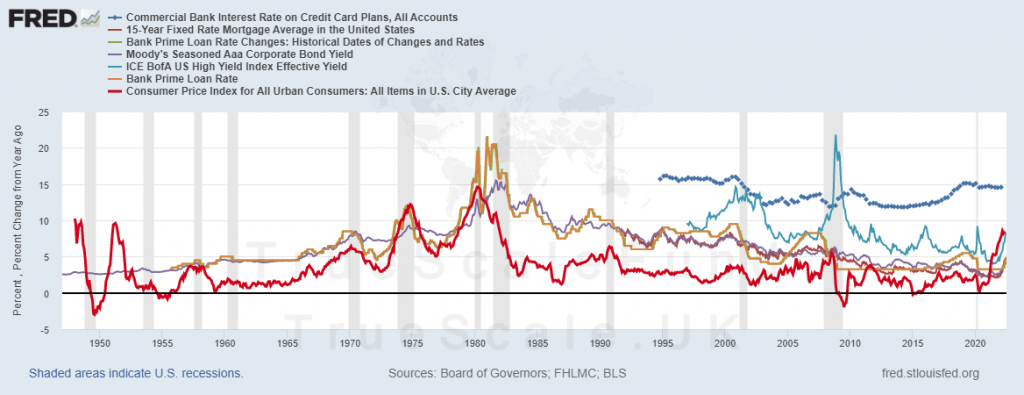

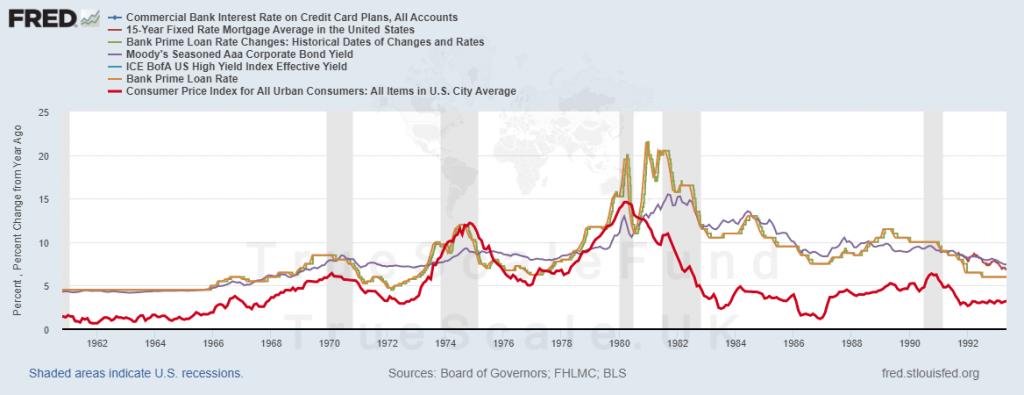

Now, let’s put all of these in a chart to see what happens when Fed rejects to increase the rate above the CPI.

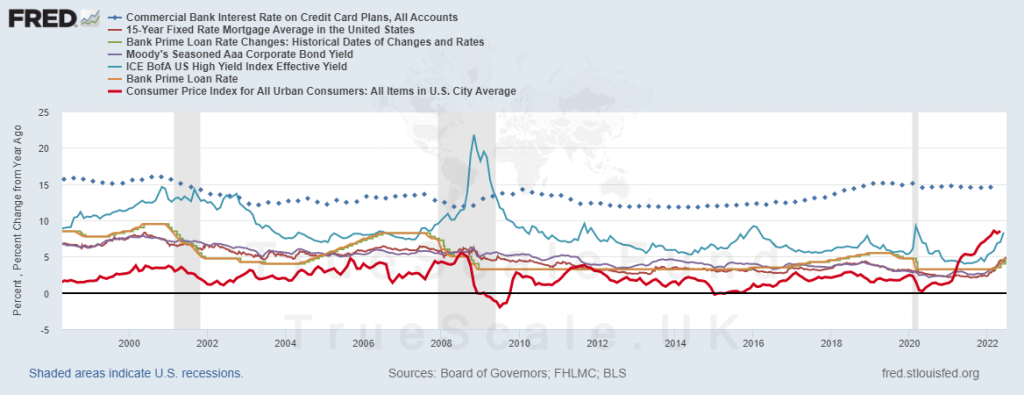

All the charts above are the same, but they show different periods. If you look at them carefully, you will see that CPI starts to fall when the borrowing rate goes above it, except in 2008 when the High Yield US bond did the job for the Fed by doubling and reaching over 20%. In the last chart, all the rates except credit card rates are lower than CPI, making sense for consumers to go into debt and spend currency on assets.

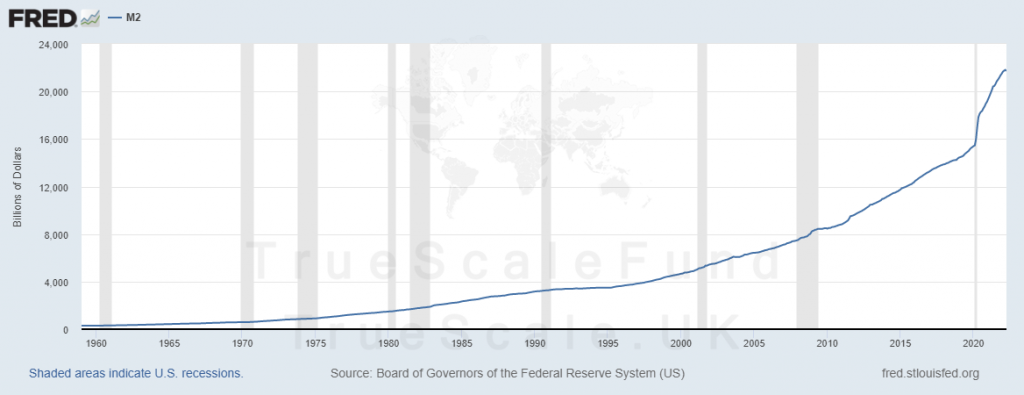

The purpose of increasing rates is to make it expensive and unaffordable for people to spend and lower the expansion rate of the money supply until the production keeps up and compensates, lowering the CPI. So, it is absurd to think with about a 4% funding rate on different assets and 8.6% CPI we can cool down the economy. In the short run, they might succeed by managing inflation expectations, but it will last until the market realizes credits inflows are higher than goods and services to buy.