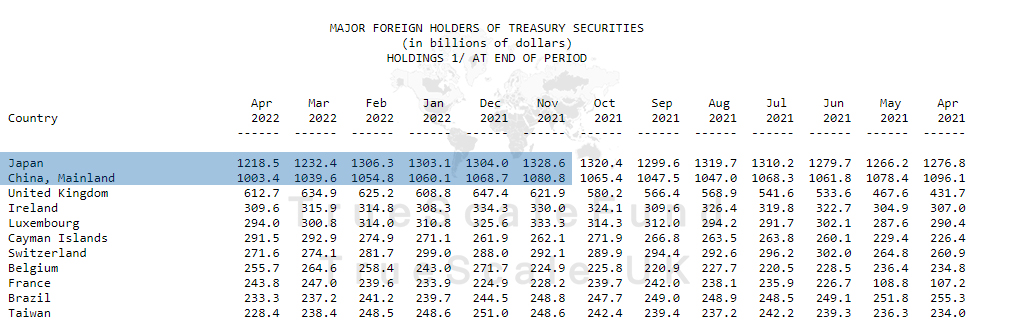

Japan, China and The United Kingdom are the largest owners of US treasury bonds, and not surprisingly, they are currently experiencing massive currency devaluation.

Japanese Yen has devalued about 50% this year, putting pressure on MOF to keep the rates at a reasonable level. The problem with Japan is that they are practicing YCC and expect the Fed to pivot more than any CBs because it would be catastrophic to let the rate goes up, and at the same time there is not enough liquidity in the bond market to sell enough treasuries to cap the USDJPY market.

The GB has already chosen a different way and has decided to resume QE while raising the rate, which will increase the cost of financing the economy, and China has difficulties repaying its USD-denominated debt.

Considering the current environment, it is highly probable to see a huge downturn in the US bond market as these participants will be hungry for USD and will have no other choice than selling their treasuries to meet their economic demands, mainly providing enough liquidity to cap the FX market or buy commodities to restart their manufacturing, or raising cash for energy imports.

With an illiquid bond market, yields on the bonds will increase and attract MMF from RRP which will increase the velocity of USD and increase the price of commodities and inflation, a truly vicious cycle.