In the last few months, we have heard a ton of reasons why the Fed should and will stop hiking rates, but since the Jackson Hole symposium, we are seeing Jerome Powell insisting on increasing the rates until the inflation cools down. The fact is the Fed will eventually pivot, but it will happen when the liquidity dries out in the banking system, something that we have not seen yet.

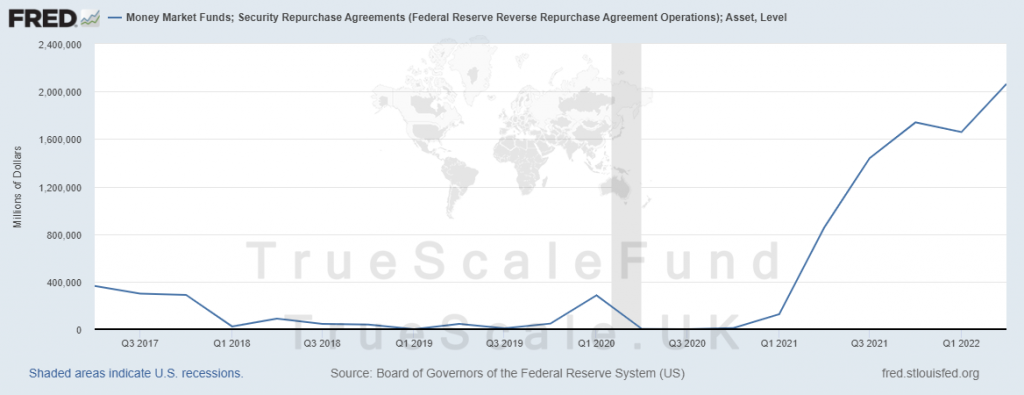

If you look at the Fed RRP facility, you can see that it increased from 0 in 2021 to about 2.2 Trillion USD in October 2022. This is not commercial banks’ reserves parked at the RRP, but how can we be sure?

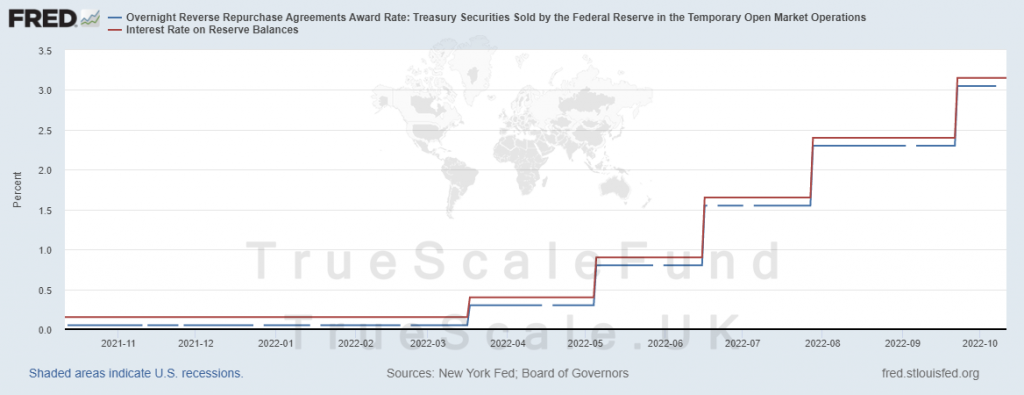

If you are a bank in the US, you can get 3.15% interest on your reserves at the fed, but the interest on RRP is 3.05%. This means that this 2.2 T$ is the money market funds that have found the interest on RRP attractive enough to lend it to NY Fed.

The deposit interest rate at major commercial banks is 0.20%, which means if you as an individual put your money in the bank you will receive a 0.20% interest yearly. This means that banks are liquid enough to not pay interest for deposits, they have tons of it and can absorb a lot more if they increase the rate.

The worst part divergence between the Fed funds rate and commercial banks’ interest rate on deposits is that the Fed might need to dry banks’ liquidity to force them to increase the rate, which is important to reduce inflation.