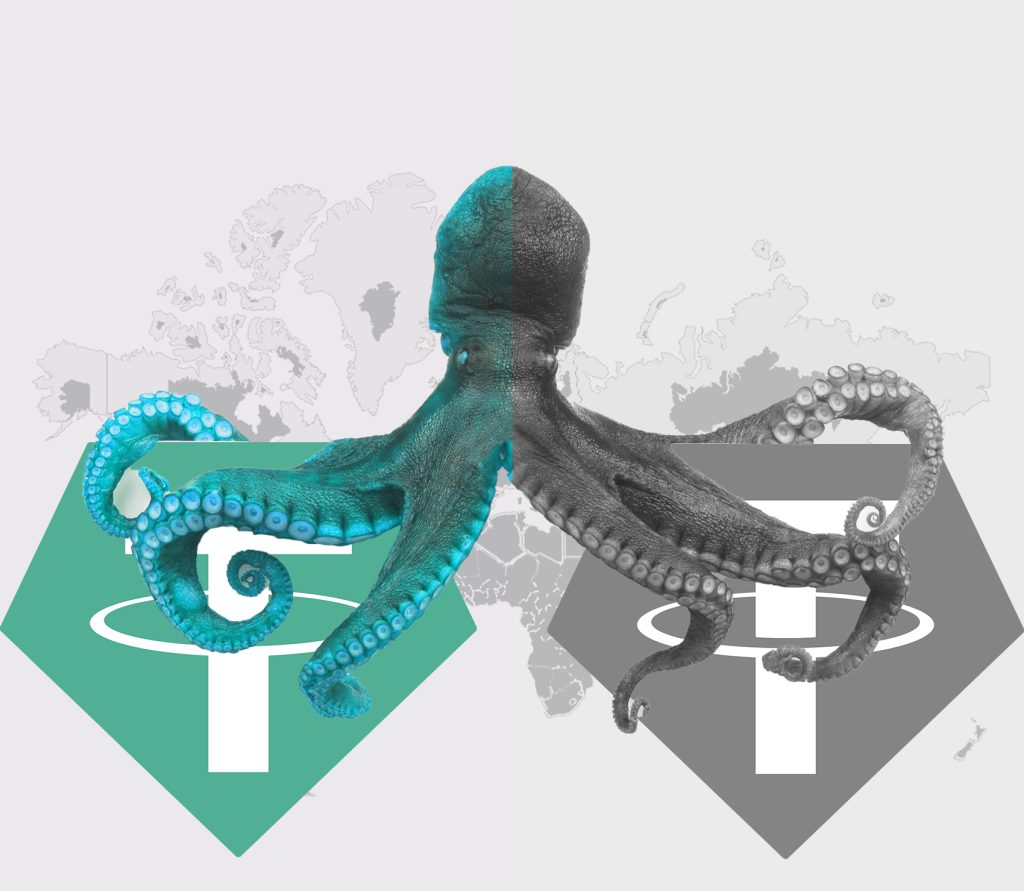

Nowadays, almost everyone is aware of the uncertainty associated with Tether’s reserves, and we expect it will eventually lose its peg to the USD. So, this article aims to focus on how Tether is helping rogue states (from America’s point of view) to reduce volatility in their local currency and absorb foreign capital.

Who are the rogue states?

- Russia

- Belarus

- North Korea

- China

- Venezuela

- Syria

- Cuba

- Nicaragua

- Afghanistan (Taliban)

Tether’s printing press has provided capital for rogue nations

A large portion of Tether’s holding assets is in form of loans to companies and institutions that Tether refuses to disclose. These are mainly high-risk, high-yield loans to Chinese construction companies and property developers (ghost city developers) such as Evergrande, Country Garden, Sunac China Holdings, Seazen Holdings, China Resources Land, Vanke, and many others, which have already defaulted on their USD denominated Bonds. Because of the secrecy of Tether, all we know is based on our speculations and assumptions, but the lack of transparency from Tether should be enough to deter investors from holding on to it.

Emerging markets and starvation for USD

Turkey

While Turkey is not a hostile nation towards the US, it suffers a severe Dollar shortage. The need for USD has enabled Tether to thrive in turkey and become an unofficial substitute for USD, which empowered them to become a shadow of the Fed and replicate its SWAP-line mechanism. The downside to this shadow liquidity-providing mechanism is that Tether swaps Turkish citizens’ assets with its token instead of the Turkish lira, sucking out capital out of the country by owning domestic goods and assets. it is estimated that with the collapse of Tether, Turkish citizens will become less economically viable. Note that Turkey is just one example and there are many countries with the same characteristics.

Rogue states and starvation for USD

Other than G7, there is only one contributing factor to the price of the major currencies in rogue states, Supply and Demand. If you have no access to the global banking system, you will starve for acceptable means of exchange, whether it is Dollars or Euros. Moreover, you cannot perform economic activities when the volatility of the local currency is high, because it will crush your profit margin or it might even erode your wealth due to a decrease in purchasing power. Thus, it is up to these states to inject enough USD, mainly, to keep the exchange rates stable and keep the volatility managed.

But, what if they can’t do so? Well, apart from barbarian methods like closing local exchanges and blaming them because of the surging rates, or passing legislation to prevent citizens from buying USD, they do perform market manipulation operations. For example, in Russia, after the US sanctioned Russian oil and natural gas, they demanded ruble payment on their energy exports, which is forcing Europe to exchange Euros for Rubles at the exchange rate provided by the Russian central bank instead of the market. That is why the exchange rate of the ruble provided by the Russian central bank is completely irrelevant and completely skewed from the rate that you get on the black market.

Another less-known way to manipulate the rate is to promise to deliver what you don’t own. Many of the mentioned states have local crypto exchanges which are run by the government’s trusted agents. The most-traded asset on these exchanges is Tether/local currency, and their main objective is to suppress the price of Tether (as a derivative of USD) to curb the demand by selling it on their platform but not delivering it. If a local crypto exchange has 1MUS$ in Tether, they might own their customers a total of 20MUS$, which is fine until a bank run happens on these insolvent exchanges.

When it happens, either these trusted agents will be put into jail for a few months, or the central bank will intervene and compensate for public losses by printing their local currency, which is obviously not a smart move as it exacerbates the inflation, but a viable tool to delay it.