Fed tightening means no money for Federal Government to spend.

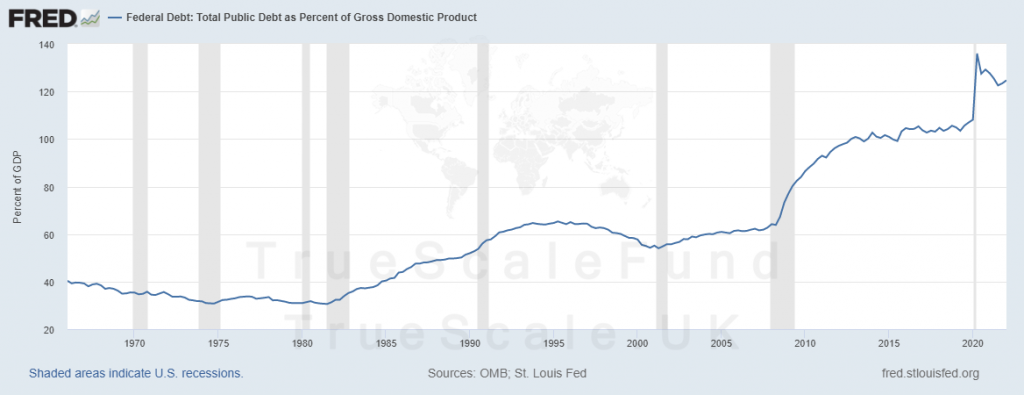

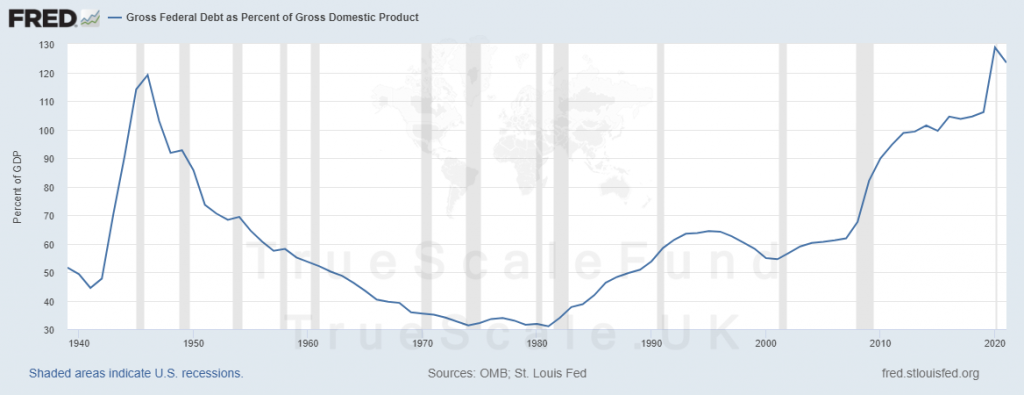

US debt has reached 30 Trillion Dollars. However, this number is irrelevant and should be compared with the US GDP to become relevant. When measured in GDP, US debt has reached 125% of its annual GDP. This is a good indicator to understand how hard it is to pay the debt without it being monetized by Fed. The healthy way to pay this without depreciating the currency is to collect taxes from businesses and individuals which seems impossible in the current economic condition as CPI hits 8.6% and personal savings of US households disappear.

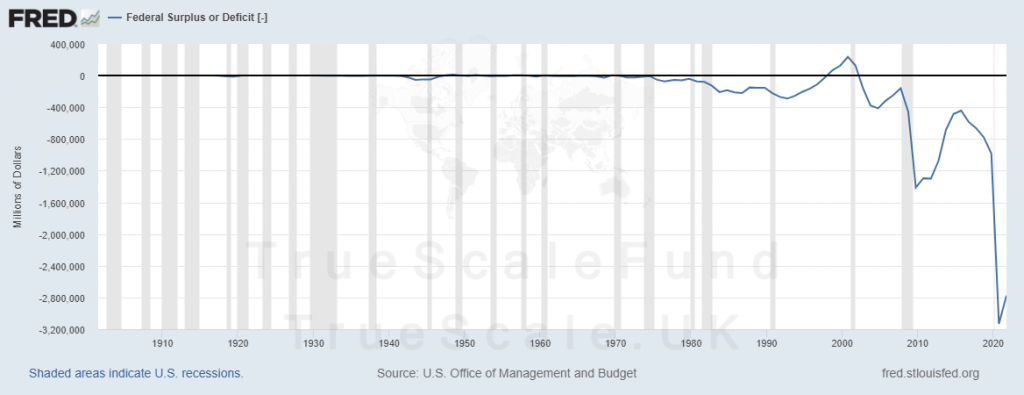

To make things worse, if you look at the Federal surplus or deficit chart, we can see the trend is toward more deficits, and even if it recovers, it will remain in the negative territory.

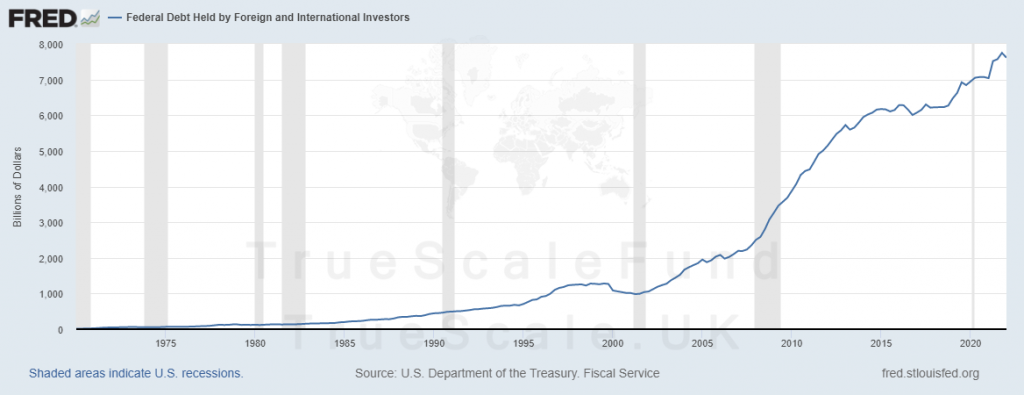

If we look at the Federal debt held by foreign and international investors chart, it is obvious that after 2013, foreign and international investors are reluctant to own more US debt.

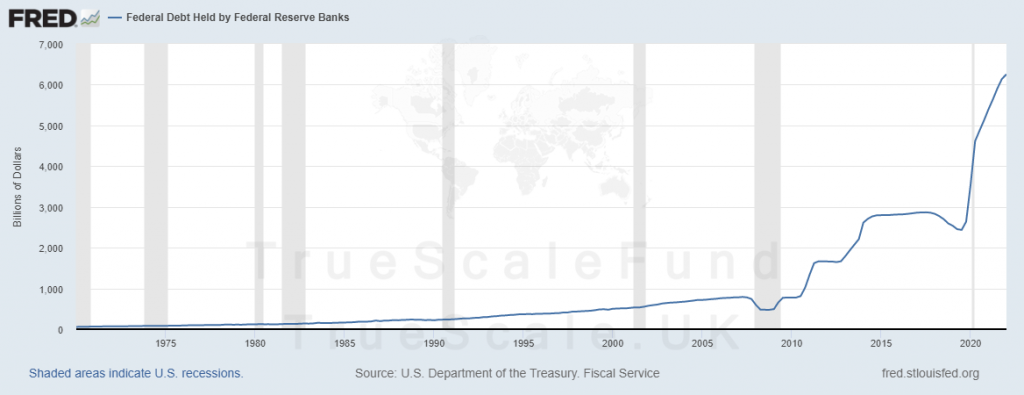

After 2013, according to the data, most of the US Federal Deficit is paid by Federal Reserve and the public investors.

A tsunami of layoffs is coming into the US.

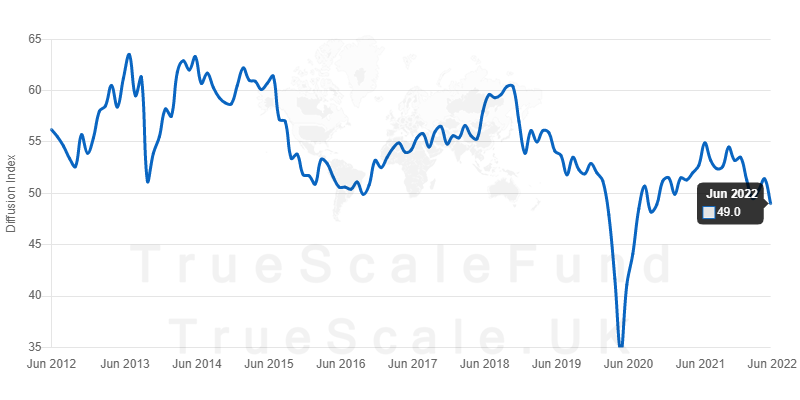

Sales Managers Index is falling and now is below 50, suggesting an upcoming recession in the US. This is bad news for the Fed who thinks that it is dealing with a strong labor market.

Conclusion

The current data suggest that Federal Reserve can cool down the inflation by raising rates above the CPI (which it is not doing) and not by selling its assets because there is no buyer other than a little demand from Commercial banks and public investors. The system is fine, but the operator is delusional. By raising rates, all the previous US debt becomes cheap (losing face value), lowering selling pressure for them. This enables the treasury to finance the Federal Government by absorbing excess liquidity from the system, which cools down the inflation.

But, what we see now is that the Fed wants to sell enough assets (even in loss) to absorb the liquidity, which is fine but it will not make treasury bonds with low-paying interest (2.875% 10Y Notes on the 15th June auction) attractive to investors who are experiencing over 8% inflation. Thus, US Gov cannot operate without substantially lowering its spending, or being financed by the Fed.