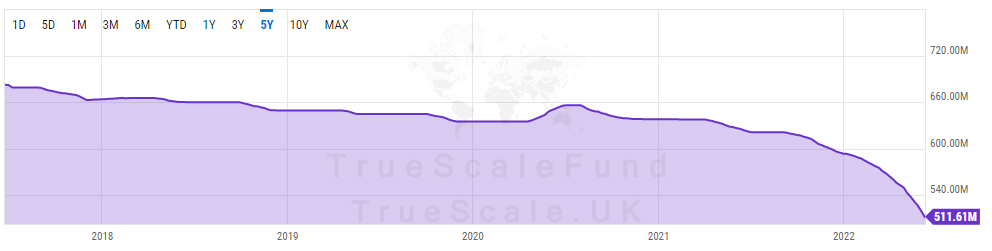

The nature of an inflationary environment is that every commodity price drop recovers and every deep is bought. The recent drop in oil is not due to excess supply or crushing demand, but a speculative move in the market. The BofA Global Fund Manager Survey data shows that in the June 2022 long Commodities is the most crowded trade, and as far as we know, when a trade becomes overcrowded, hedging activities increase and push the price lower. In addition to this, Biden’s administration started to exhaust US strategic petroleum reserves even before the Ukraine war, a drop from about 620M barrels in mid-2021 to 511.61M barrels on June 10th, 2022.

Because of this offloading, longs are getting exhausted, closing their position and driving the price lower.

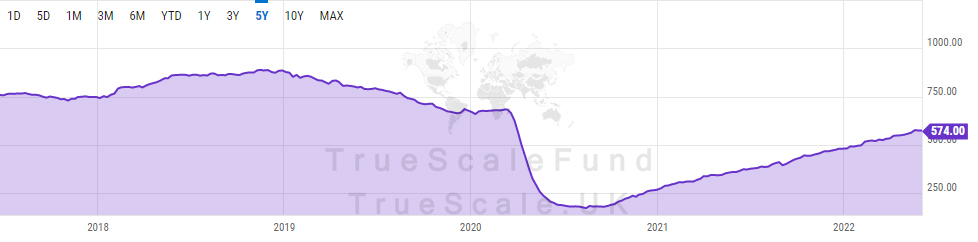

After the infamous oil crash in 2020, many small oil companies have declared bankruptcy in the US, exacerbating the shortage of oil. According to the oil rig data, the number of active oil rigs has never recovered to the levels before 2020.

After all, we have to remember that it was Biden who promised to reduce oil drilling, discouraging oil companies from reinvesting in the industry.

Bonus: China is reopening, putting more pressure on demand. We know that the Chinese have an appetite for Russian cheap oil, but Russian oil is still flowing into the market and there is no excess production there.