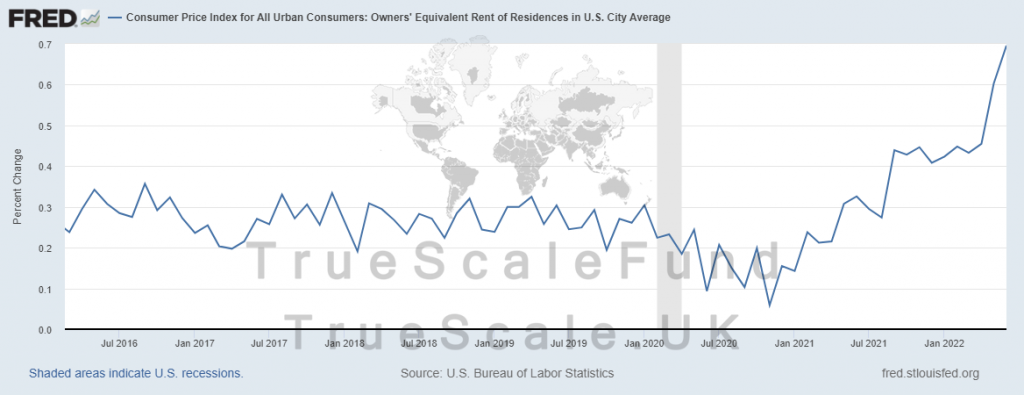

The new update on the owner’s equivalent rent shows a 0.7% increase compared to the previous month.

Considering today’s CPI reading, 9.1%, this piece of data suggest that the Fed has cornered itself by not responding to the inflation at the proper time, suggesting it is transitory.

With a 9.1% CPI, the Fed has to react to the inflation by rising the rates higher in the next meeting to cool down the economy which will push the mortgage rate higher. This alone is enough to prevent those in need of a new home from buying one and force them to rent one, resulting in a higher rent as demand increases. To exacerbate the situation, those who have recently bought a property with an adjustable mortgage rate, if they cannot afford their mortgage, will be forced out of their homes, adding more pressure on the housing rental market.

In the current environment, the Fed needs to be careful about how much they want to increase the rates in the next FOMC meeting because a lower-than-required rate hike can push the CPI higher, and a higher-than-required rate hike can make millions homeless across the US.

We, at TrueScale, believe that this is the start of the collapse in the housing market, but the price of the homes may not experience a fall as it had back in 2008.