In the past few months, a domino of defaults has started with the crash of Luna in the crypto market, which has led to deleveraging events and a few bankruptcies in the sector. Many analysts believe that with the liquidation of speculators and leveraged money, we have reached the bottom in crypto assets. While this assertion technically makes sense, it omits a significant fundamental risk, the solvency of centralized stablecoins.

It is worth reiterating the notion of market cap here since the misunderstanding of fundamentals can lead to catastrophic decisions in financial markets. When we say the price of Xcoin is 3$ and the total amount of Xcoin currently floating in the market is 100 coins, the market cap of Xcoin equals 300$ if you can sell each of them for 3$! If you find the buyer at 2$ for each coin then the market cap drops to 200$ immediately. However, this is not the case with stablecoins. They are, in theory, representative of USD bills secured in a bank that can be redeemed anytime. Except for DAI, an algorithmic stablecoin, we have three major stablecoins namely Tether, Circle’s USDC, and Binance’s BUSD each having a 65, 55, and 17 billion dollar market cap respectively. From these three, USDC and BUSD are highly regulated and it is improbable to run out of reserves. However, Tether is not regulated and its discrepancy in its collateral exposes the whole market to a major risk if a bank happens on its reserves.

So, what happens if Tether goes to zero. If you ask market newbies, like Mikel ‘Drunken’ Sailor, they say Bitcoin stays at the same price and Tether becomes worthless, but if you are an experienced trader you know that with the withdrawal of liquidity from any market, upward trends stalls, and then price fells lower to attract liquidity.

The demise of Tether is not like removing a 55B$ market cap from an 800B$ market. it is more like removing a revolving 55B$ liquidity ( let’s take 4X impact factor which gives us about 220B$ ) from low-velocity assets that sit in wallets (let’s take 0.3 impact factor which gives us about 240B$ ). Thus, even a 50% drop in USDT/USD price will result in a 10,000$ BTC price.

The probability conundrum

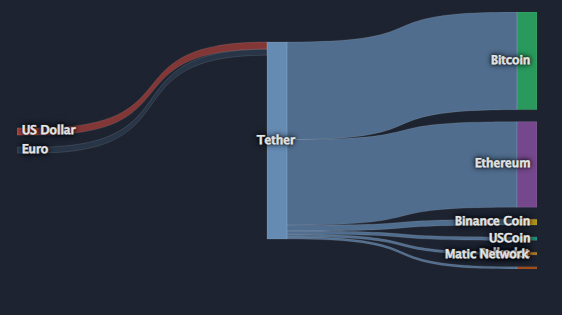

Calling Tether a scam is easy and hard at the same time because it is up to the market participants to decide if they are going to abandon it or not. Day by day, we become more aware of the fact that Tether is not 100%, not even 50% backed by USD as the pieces of evidence pile up. For example, we know that the major inflow of funds to tether is from exchanges, not individuals and if you look at the inflow/outflow of currencies into and out of tether, a big chunk of it seems to come from nowhere!

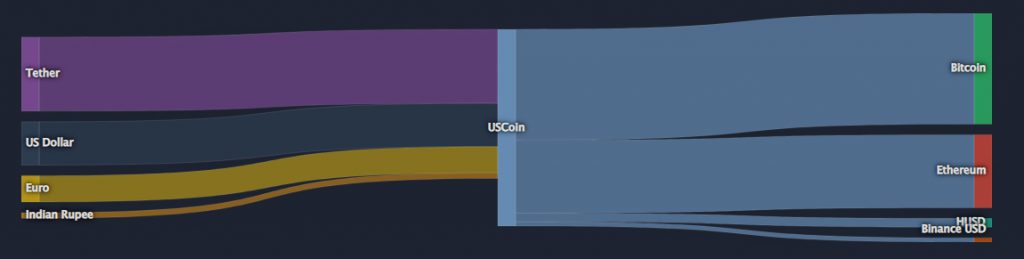

Compare it to the USDC flow, which clearly is a derivative of USD.

All in all, the faith in Tether’s redemption delivered them a printing press to support the price of digital crypto assets by creating artificial demand and putting a floor under the price of Bitcoin. However, now, the company faces a major risk of a bank run and might halt USD redemptions, which clearly cut off their access to the printing press. In a best-case scenario, if tether manages to stay around, there will be no crypto bull market for a long time.