Unfunded liabilities are Government obligations toward people or entities which have not yet sourced and work as leverage on central banks to print money. A big portion of these liabilities is social securities such as pensions, health care aids, and insurance.

In a world where the population growth is above the replacement rate and the unemployment level is low, governments can dedicate a percentage of their tax revenue to pay retirees and healthcare system, but when the population growth slows or unemployment level rise, the tax revenue drops and forces them to find other sources to fill the gap. Some countries try to compensate for the drop in tax revenue by exporting more goods or commodities overseas and some try to issue bonds and sell them to foreigners.

The overall trend of the balance of trade for the US always has been negative but its bond always has been an attractive investment for foreign govs and individuals. Over the past 50 years, the high demand for USTs has enabled the US to add and expand its expenditures, but now the shortage of dollar cash caused by the rising price of commodities has slashed the treasury outflows, leaving the fed as the major financier of the US debt.

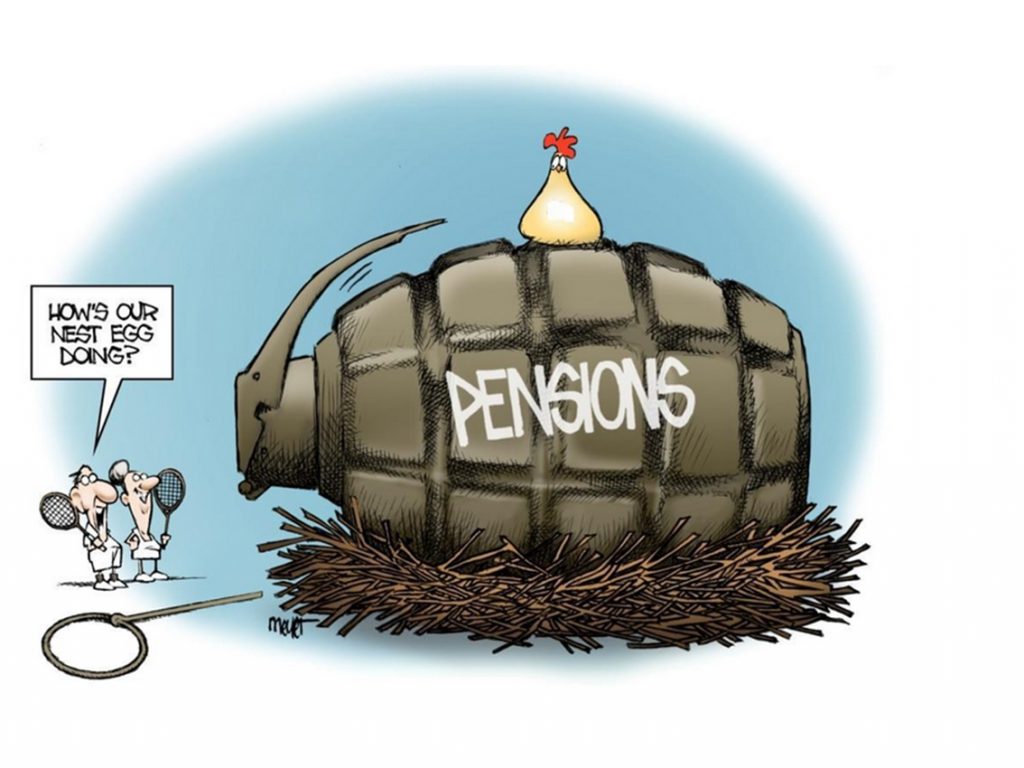

So far, Fed has failed to sell any treasuries to tighten the economy, and that is not a surprise to us since the US has over 90 trillion dollars in unfunded debt. Soon, they have to start expanding their balance sheet to monetize the debt otherwise US citizens will lose their healthcare benefits and retirement pensions.