COMEX and NYMEX are getting depleted from gold, silver and other precious metal reserves at a pace never seen before. This is more concerning when you look at the chart and see how prices of these metals are squeezed to the downside, creating a setup for a highly likely short squeeze. So, what happened that let the price of precious metals fall?

1. Fed tightening policy and the change of sentiment

The major contributor to the price decline in the precious metal sector has certainly been the change in sentiment. As soon as the Fed started to raise rates, investors and speculators lost their interest in the precious metal sector and started to accumulate cash to buy cheap bonds.

2. Russia-Ukraine war

War is bullish for precious metals like gold because it is considered a hedge against uncertainty. The problem with this thesis is that gold plays well against the uncertainty of your currency. If you live in Russia, Ukraine or Europe, gold has certainly played well against your local currency. The other problem is that we consider the US dollar as a safe haven, the more demand for USD, the lower the price of metals.

3. Algorithmic traders

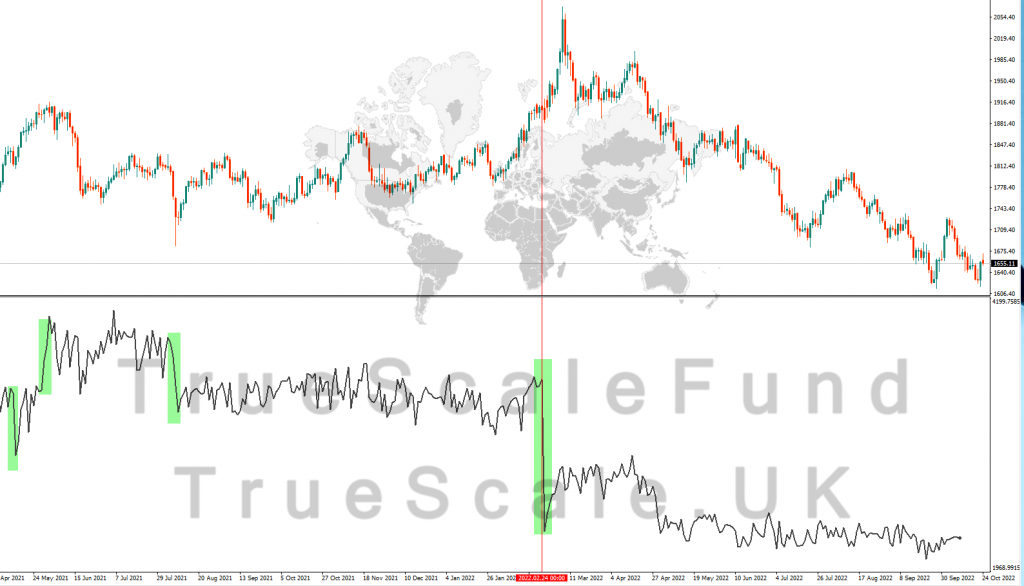

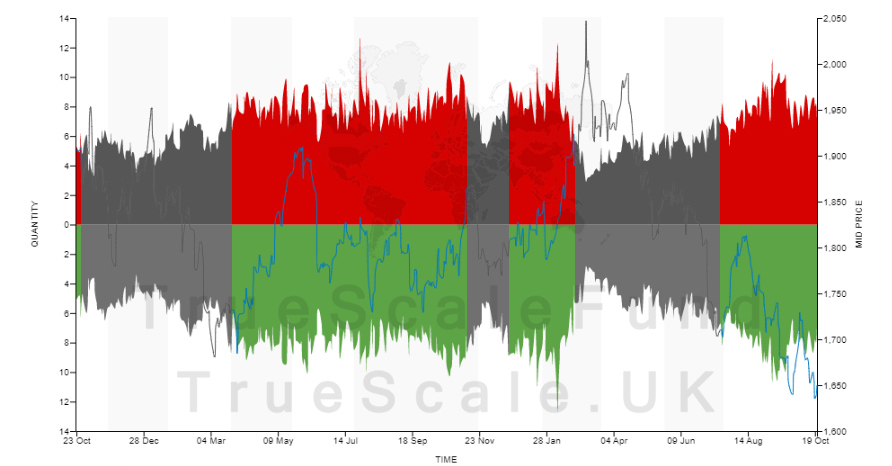

If you look at the chart below, you can see that on February 24, liquidity in the gold market evaporated and fell to the lowest levels since the start of 2019. This is an important factor to consider because the price seeks liquidity and will move to the levels at that liquidity is available, in this case between 1800 and 1600.

This drop in liquidity is mainly due to the algorithms closing their shorts, which turned into a short squeeze after Russia invaded Ukraine.

But the question is who is on the sell side? Algorithms again. Algoes keep selling metals since the start of 2022 and apparently not taking any profit, and now we have reached a point in the history of precious metals trading that COMEX is out of inventories. If the word spreads, at which levels will these algoes be able to buy to net their positions?