Yesterday, Jerome Powell came out with a moderately dovish statement on future rate hikes, which was surprisingly odd, in particular, after his last statement in which he insisted that the rate hikes will continue until they get the job done, reducing the inflation to their 2% target rate.

It is obvious that the last better-than-expected CPI number was due to the lower energy price and the fall in container shipment cost. The former is influenced by releasing a huge amount of SPR into the market and Lockdowns in China, and the latter is caused by a reduction in goods shipped from China.

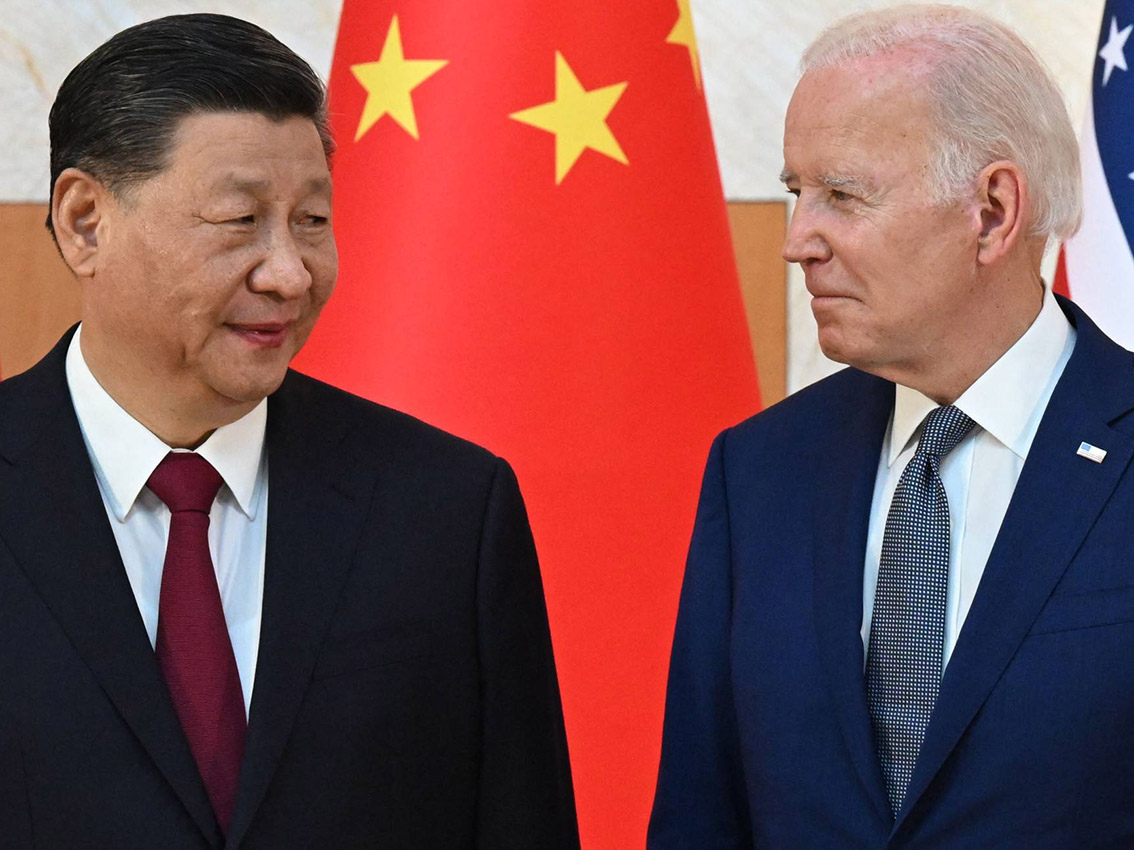

The lockdown itself plays a significant role when it comes to reducing inflation in the US because when the producer’s demand for commodities and materials evaporates, prices start to fall. But why should China care about US inflation?

First, China cannot afford a higher interest rate on the USD and if the Fed continues to push it higher, they either have to increase the interest rate to control the Yuan depreciation, which equals recession or have to let the Yuan lose its peg. Second, China is the second holder of UST and has sold a significant amount of its UST reserves in the market with a lower than face value.

If you think about it, the purpose of lockdowns is to give the US temporary inflation relief, so China can liquidate enough of its UST reserves and brace for the economic impact in China that will come when the Fed realizes that the inflation is not going down and needs a higher interest rate. However, the lockdown in China is providing the Fed an opportunity for a soft landing since it slows the pace of increase in PCE and CPI. Moreover, it is Killing the Chinese industrial sector and household savings, infuriating rage across the country.

To sum up, the main loser of this battle, or cooperation, between the Fed and CCP might be the CCP when they realize that the rates will stay elevated for longer than they expected in the US and every jump in inflation numbers proceeds with a proper response from the fed.