As we have said and warned here before, with Fed tightening the economy, many economic data and indicators are turning red in the US. 2-10Y has reached a new low since 2000 and other data such as Dallas Fed Manufacturing Index has missed big time with -22.6.

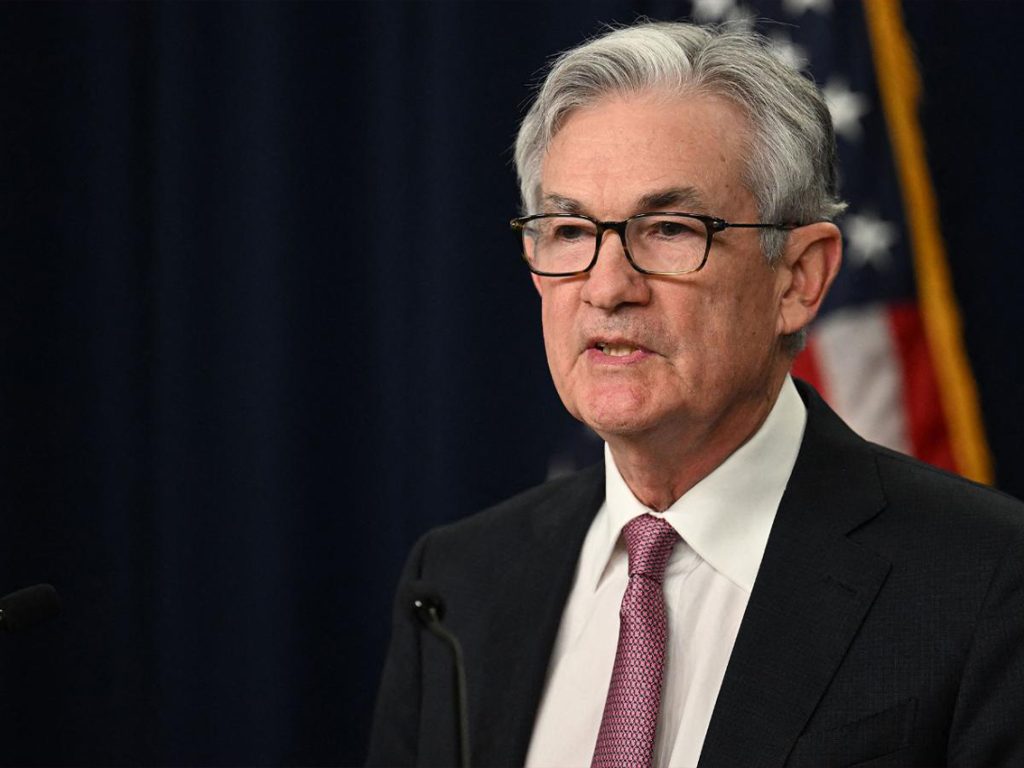

For this week, we are eyeing Wednesday’s Fed interest rate decision to see if they will go with 75BPS or 100BPS. If the first happens, we can say the Fed knows that the GDP number for Thursday will be lower than 7.9% and they need to stop raising rates. If the latter happens, we might get a GDP number slightly higher or 7.9%. However, there is a small possibility that we miss the number by a slight margin and get a 100BPS rate hike, which in this case the next rate hikes will become catastrophic for the economy, so we might never get them in the next few months.

In all cases, the GDP number that we will get on Thursday is outdated since it will be priced in Fed’s interest rate decision.