It is not an exaggeration to say that we have the worst Fed so far wheeling the US economy. Just in the past year, we heard Jerome Powell saying that the committee doesn’t think about raising the rate, inflation is transitory, the supply chain is the primary cause of inflation and more statements like this, which they eventually step back from and cave. This is completely different from Greenspan, Bernanke or their previous Feds that enacted based on their economic models, even if they were inefficient, rather than eyeballing the economy, and is creating a sense of uncertainty amongst the business owners and entrepreneurs. An undecisive Fed can put the economy in a state where it becomes unpredictable by economic data, rendering all the predictions and future plans obsolete for economic participants.

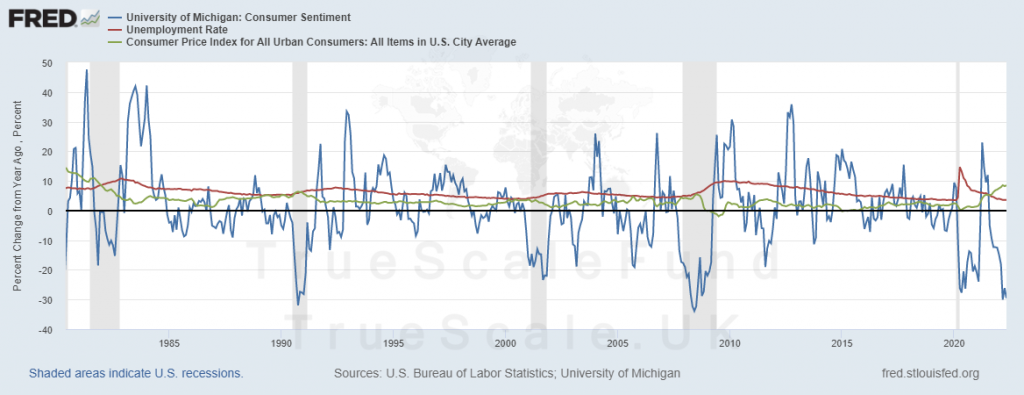

If you look at the chart below, you can see when the upward change in CPI starts to accelerate, consumer sentiment drops, which is totally understandable as their buying power starts to shrink. If it drops substantially to a certain level, it is followed by a substantial rise in unemployment numbers which tops when consumer sentiment starts to accelerate in the positive direction. This is also easy to understand; a drop in buying powers forces businesses to cut their budget and let go of those who think are unsuited for the job.

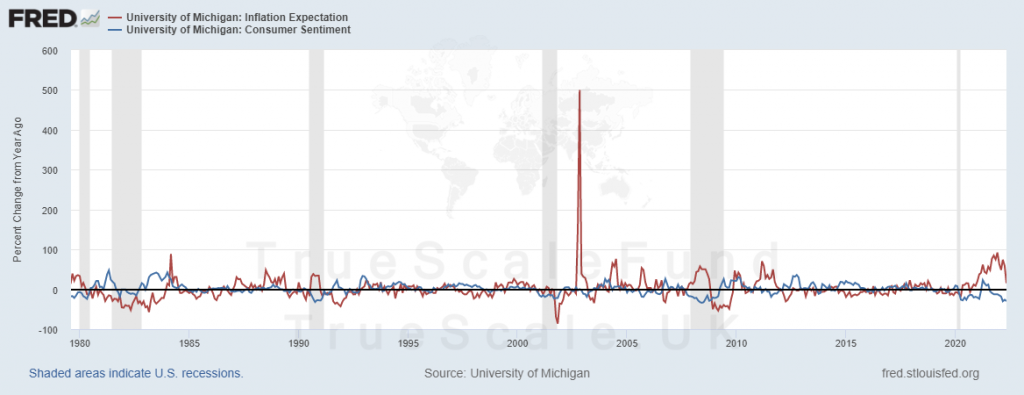

If you look at the chart below, when the upward change in inflation expectations turns downward, CPI growth slows down, and the economy cools down.

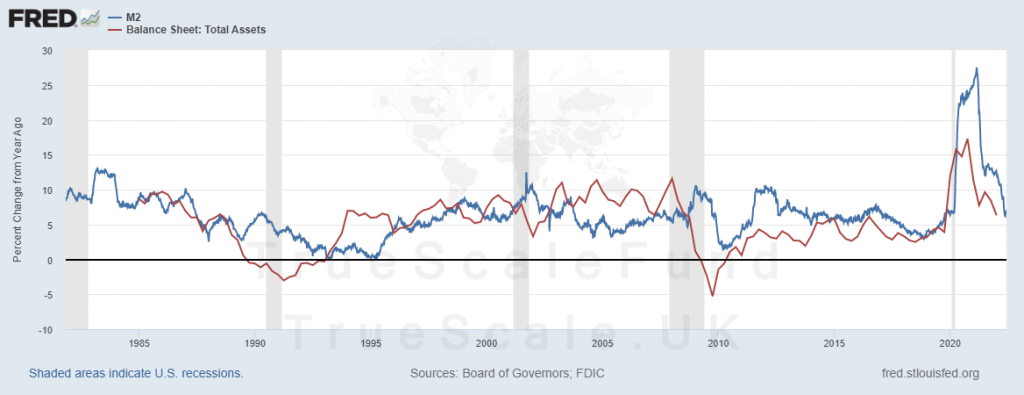

But, what is behind all of these fluctuations? The credit for sure. When an economy is broken, it is broken like a balloon with a hole in it not like a broken car, and the money supply act as inflating gas in this system. As long as we keep the hole managed (Bond Market), with enough air inflow we can keep it floating and even go to a higher or lower altitude based on the economic topography and fix unemployment or lower the inflation. However, when the faith in US debt erodes (a bigger hole) either due to political or financial conditions (which thanks to the US president and chairman of the Fed we have both), the only way to land will be a massive monetary easing or restoring the faith in the system by offering higher interest rate on the US debts as it becomes riskier to own.

All in all, this is not good news for the US workers because either they keep their job and become less economically viable or they lose their job and experience a lower level of inflation.