There is a lot of debate among economists about the nature of Quantitative Easing. Some believe it is not different than Printing currency, others think it is not. In this article, we debunk this myth and tell you how one of Chairmans of the Fed has orchestrated the biggest monetary deception of all times right in front of everyone’s eyes. But, before we start, let’s have a look at Ben Bernanke’s view of QE.

In this interview, he mentions that increasing the bank reserves at the Fed was not financed by taxpayer money. However, it is unclear whether the purchase of troubled assets like MBS and others was done using taxpayer money. After all, it is newly printed reserves and can be dismissed as taxpayer’s money because it is the Fed’s currency.

Under a fractional banking system, commercial banks are able to lend approximately 10 times the reserves that they have, and it is a beneficial practice since it allows the economy to expand without any need to expansion of base money. Commercial banks use this method to assign credit to those who are eager to involve in economic activities, such as building shelters or running a new factory, and the assigned credit is anticipated to be paid back to the bank so the credit can be removed and normalize the bank’s balance sheet. In this system, as long as banks estimate the credibility of borrowers and the profitability of their business plan, the risk of losing credit is minimized. But, what if they do bets on assets and loans to speculative investments, like what happened during the 2008 housing bubble? If they get a 1% haircut on their total created credit, assuming that they are already 10x leveraged on their reserves, their ability to create new credit falls by 10%, and a 10% haircut means that the bank can no longer offer loans until it liquidates all the assets that it has to make up for the credit loss, which is no different than shutting down. In this environment, depositors run to the bank to convert their bank credit to Federal reserve notes. This is simply not possible in any bank in any place, except if they keep depositors’ money in their vault and make no loans, and central bankers are aware of this fact. This is why they try to ensure deposits using different schemes such as FDIC to prevent such a bank run.

After GFC, the Fed intervened to buy troubled assets from banks to provide liquidity. For sure there is no problem with this practice and the market expects that to happen from a lender of last resort. This was a transfer of credit into bank reserves, an attempt to absorb the bank credit losses by the Federal Reserve, to ensure that banks can lend out credit, and this was not going to end up in hyperinflation because the amount of this handout compared to total credits available in the system was negligible. However, it comes with inflation expectation.

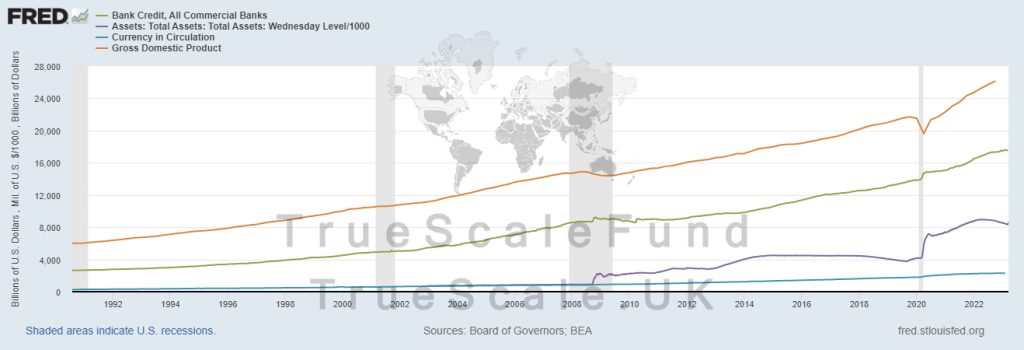

It is obvious that the ratio of Central Bank assets to credit is growing fast, which means the banking sector’s losses on credit continue to grow. This is a sign of misallocation of credit, a pile of bankruptcies, and drops in real economic growth in the past and present. For sure, without CB’s pumping reserves to absorb credit losses, the GDP would fall and we would experience an economic shutdown followed by a depression.

So, is QE printing money or not? If you understand the difference between bank credit and federal reserve note, the former is created to be eliminated and the latter is created to stay in the economy, you would know that confidence in a credit-based economy is intact until the market believes that the credit is safe and sound and will be repaid. A loss of confidence in such a system would be followed by a rush into true safe-haven assets such as commodities and CB’s banknotes, and a revaluation of the GDP. If the credit is lost, then there is no GDP forward. However, CB’s buying assets to make banks’ balance sheets stronger is nothing different than CB replacing the lost credit with reserves which will increase the credit cap for the banking system. This does not create inflation in one night, but as banks continue to lend and expand their balance sheet, and continue doing risky bets, gradual inflation erodes the purchasing power.