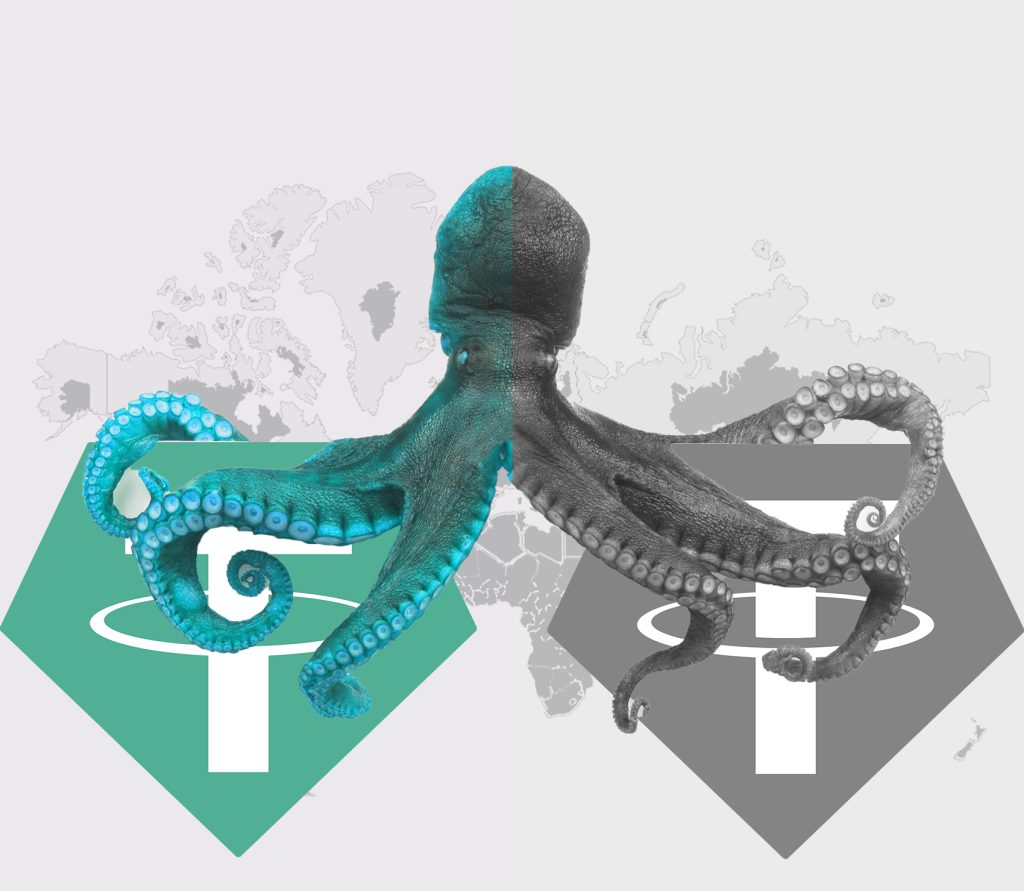

Over the recent years, discussions have revolved around the resilience of stablecoin reserves and their potential eventual decline. However, with the exception of Terra-luna, this foreseen downfall has not materialized, especially concerning the highly debated stablecoin, USDT. In this piece, we aim to elucidate the correlations within the latest advancements in the cryptocurrency realm. Our objective is to demonstrate the plausible reasons behind our belief that Tether’s longevity is limited. Consequently, we suggest that investors consider temporarily redirecting their focus from the crypto market and explore alternative investment avenues for potentially higher returns or yields.

It appears that the United States has begun to acknowledge the existence of unregulated entities that produce counterfeit USD without any intention of adhering to regulations or oversight. This is not an entirely new revelation for them. Some years back, they confronted an online bank called Liberty Reserve, which effectively functioned as a creator of illicitly sourced USD. The solution for handling Liberty Reserve was straightforward: dismantle the website and apprehend the involved parties. However, addressing the issue of crypto counterfeiters presents a more complex challenge. Given that a majority of these illicit actors operating with cryptocurrencies are beyond the scope of US jurisdiction, and due to the near-impossibility of disabling the associated tokens, an alternative strategy has emerged. This involves compelling stablecoins to align with their intrinsic value through the influence of market dynamics, offering a more refined approach to addressing the situation.

For smaller participants, compelling Tether to revert to its actual value proves exceedingly challenging. This difficulty doesn’t stem solely from Tether’s reserve backing; rather, it’s due to the entity’s role as a circuit breaker. Whenever the market inclines toward driving the price toward its inherent value, Tether intervenes by initiating the redemption of a portion of its tokens, thereby creating the appearance of substantial reserves. If you read the redemption terms, you would notice it is not easy to redeem your tokens, and it is by design to stop and discourage you from doing so.

A couple of months ago, CZ and Binance got sued by the CFTC. The allegations were about serving US customers, shady KYC practices, money laundering, and helping with illegal transactions. It looked like the first step to stop the flow of USD into an exchange where most of the trading happens in USDT. When Binance halted USD deposits, the price of BTCUSDT shot up to 138K while BTCUSD fell to 17K. That was a clue that the market was valuing USDT at only around 12 cents.

After a few weeks, before temporarily taking down the BTCUSD pair, the price of Bitcoin in USD started to differ again from the BTCUSDT price. Removing the BTCUSD pair seemed like Tether’s way of covering tracks like they knew they were in trouble and wanted to erase evidence before traders caught on. Then, suddenly, the BTCUSD pair was back on the Tradingview, and the prices seemed to match up as if nothing happened. At this point, saying Binance is acting more like a magician than an exchange wouldn’t be an exaggeration.

This move by CFTC has a big shock that will affect all the shell exchanges run by Binance, in particular those operating in Hong Kong. Most of these exchanges will go under, buying time for Binance and Tether.

In the Terra-Luna ecosystem, Terra was a stablecoin supported by Luna. The higher the price of Luna went, the more Terras were added to the system to keep its price under 1$. When confidence in Terra diminished and lost its peg, the first choice was to increase the supply of Luna and buy back Terra to push it back to its 1$ peg. USDT inherently lacks this feature. However, with DeFi becoming more prevalent among stablecoin Yield seekers, USDC has put a backstop against sudden moves in USDT price. This helps Tether to maintain the peg much more cheaply compared to a scenario in which they had to redeem all of their tokens with USD.

After cutting Binance from the US, the next level for enforcing USDT to fall to its true price is to increase the concentration of USDT in countries in which it originated and reduce these nations’ exposure to USDC.

By forcing US-based Exchanges to denominate their crypto assets either in USD or fully audited stablecoins, USDT will be cut off from a big liquid USD market. To understand the level at which this move can impact the USDT, imagine you have 10M USDT in your wallet. If you decide to convert it to USD in an African country, you might push the USDT price lower in that market because of selling into an illiquid market. However, it would not matter if you want to cash it in the US, because everyone has USD in their pockets and you can sell it to anyone without causing market disruption.

Right now if you employ this method in an African country, it might not affect the price of USDT, thanks to the abuse of USDC and DeFi which ensures buyers that they can change their USDT to USDC. USDC is a much more transparent and easy-to-redeem coin and it is almost impossible for regulators to abolish it. However, adding KYC measures for existing wallet addresses and blocking funds related to illegal activities will discourage liquidity providers on DeFi ecosystems, which we believe is coming soon with today’s news on PayPal.

A few days ago, PayPal announced that they have launched a cryptocurrency named PayPal USD’ (PYUSD), which obviously was going to be abused by Tether. Today they were Hit with news that banks should not work with Paypal anymore.

This is clearly the last warning sign you can get from the market. When USDT goes to its intrinsic value as Terra did, the price of Crypto assets will no longer be as high as today because of evaporating liquidity. The days of USDT have numbered and there are too many red flags to ignore. Let those who created this beast suffer its consequences, not the people of the free world.

FUD. Fear, Uncertainty, Doubt. A Rus-Chinese propaganda that tells you if I cannot lift a 2000 LBS weight, it is not because I have no training. It is because you do not blieve in me!

Any Crypto bot on Twitter (X)