The Market Situation Report is a condensed version of our institutional newsletters, infused with a touch of humor. We plan to release it daily, right before the opening of the US market, and present it in a most familiar format to retail traders’ eyes by using Tradingview charts and Memes. To learn about the incentives behind it you can visit the link below.

Time to Step Away from Nasdaq—For Now!

It might be the right moment for traders to reconsider their position in the Nasdaq 100, the leading technology index in the U.S., and instead, focus on safer assets like Gold or Cash. Recent market trends indicate that the giant tech sector is struggling, calling out for the Federal Reserve to inject more liquidity into the system to sustain its upward trajectory.

Please read previous issues of this newsletter first.

Nasdaq: The Market’s Cash Absorber

Investors have long recognized that the Nasdaq 100 acts as a massive liquidity absorber. Every time the Federal Reserve floods the market with cash, this tech-heavy index absorbs it. This is no coincidence.

For years, the U.S. tech sector has been at the forefront of global innovation. From semiconductors to social media platforms, the Nasdaq hosts some of the world’s most influential companies. Take, for instance, the global use of platforms like Instagram (now under Meta). While Western social media apps thrive in places like China, when visitors from China come to the U.S., they don’t see similar adoption of platforms like WeChat. This stark difference underscores the dominance of U.S.-based companies.

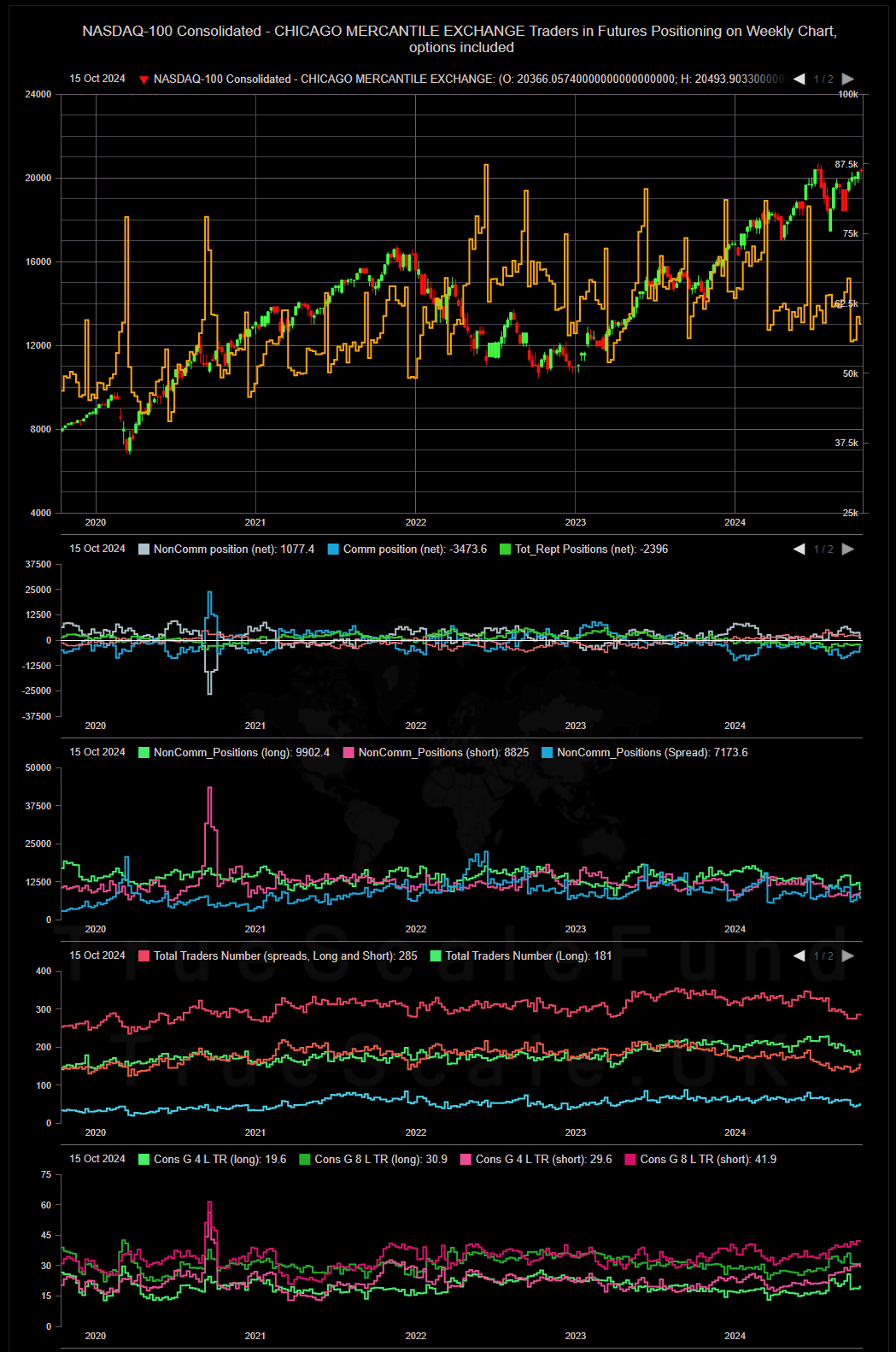

- The Nasdaq open interest has not been doing well for the past years.

- Non-commercial short positions have not been doing well. if non-commercials are not shorting the market, the incentives to make higher highs erode away.

- another issue is the high CPI report of the last week. although the CPI is bound to come down if the Fed hesitates to cut more or tries to stay at the higher rate for a longer time, market participants might look for other possible options that give them better returns, and trust me they are actively looking for that is why gold and silver rockets up, and that could possible weakens the NASDAQ.

What’s the Best Move Now?

In light of these developments, the prudent strategy is to avoid Nasdaq for the next three months. This gives us time to reassess market conditions. We can either buy at a more attractive price or wait for a convincing breakout before re-entering the market.

Disclaimer: Engaging in trading is a challenging endeavor that demands careful consideration and should not be undertaken by individuals indiscriminately. It is crucial to acknowledge the potential risk of losing one’s initial investment in instances of erroneous trades or excessive exposure to a particular asset, especially when employing excessive leverage. Consequently, we strongly advise utilizing prudent investment solutions to administer and safeguard your portfolio effectively. Visit Investing Solutions for more information.